With summer barbecues lighting up across the country and BLT season around the corner, the time has come for those in Canada’s hog/pork supply chain to breathe a little easier and take note of some good news. After several years of sector-changing challenges that have led to major restructuring of pork processing operations and hit a number of producers especially hard, some price stability and bullish factors supporting pork production have finally emerged.

Inventories are falling

To say that 2023 was painful for hog producers is an understatement. The glut of hogs stemming from fading sales to China and weak domestic demand, made worse by shuttered processing plants and reduced slaughter capacity, led to sinking prices and squeezed margins. But things are now starting to turn around for the industry.

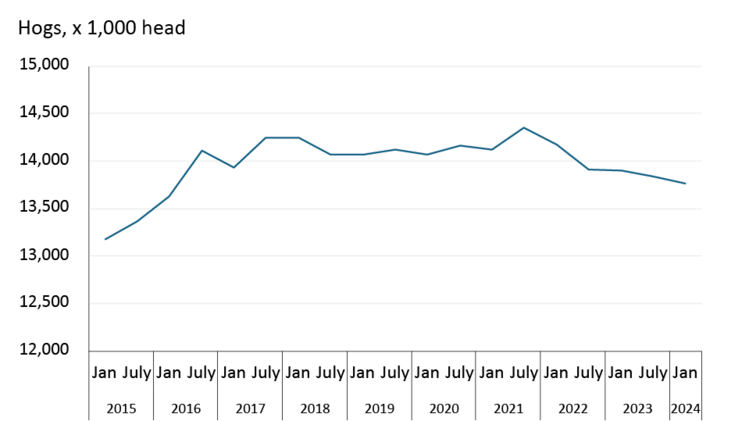

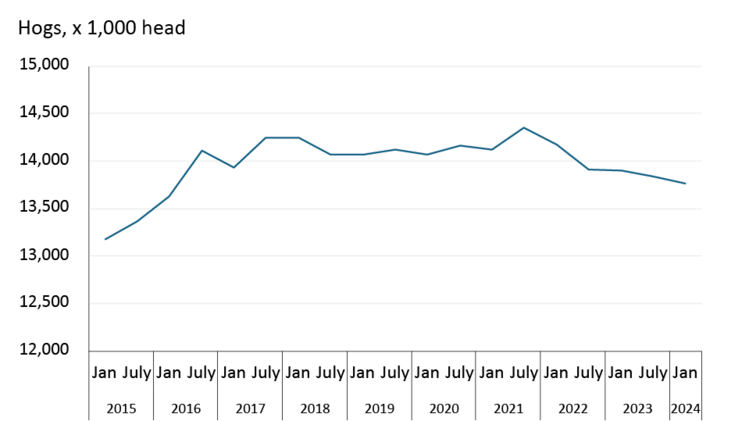

Canada is still dispensing with a glut of hogs, in part by dramatically increasing the number of live animals sent to the U.S. for processing. Between January and April, over 561,000 market hogs have gone to the U.S., an increase of 144,000 from the year before. That’s helped bring some balance to Canada’s overall supply after years of tumbling prices in chaotic markets (Figure 1).

Figure 1: Canadian hog inventories on the way down

Source: AAFC

Although our 2024 outlook indicates Canada’s hog sector isn’t completely out of the woods yet, the year is breathing some life back into hog production. We last provided an outlook for the hog sector in January, when we forecasted 2024 prices to stabilize or rise year-over-year (YoY). That was a welcome sign then, and it continues to hold now in July (Table 1).

Table 1: Hog prices remain elevated in July throughout the outlook period

| Livestock prices | 2024 forecast | 2023 average | 5-year average |

|---|---|---|---|

| Ontario market hog $/kg | 2.30 | 2.20 | 2.10 |

| Ontario feeder hog $/kg | 2.10 | 2.00 | 1.90 |

| Manitoba market hog $/kg | 2.25 | 2.25 | 2.10 |

| Manitoba feeder hog $/kg | 2.05 | 2.05 | 1.90 |

| Isowean $/head | 40 | 45 | 50 |

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

Better prices in 2024 on average

All price forecasts for the current year (except isoweans) are higher than their respective five-year averages. But there’s some good news for isoweans too: their price has risen since January. Hog prices have, overall, risen then stabilized in 2024, in part, as a result of the improving balance in hog supplies.

Pork producers can also thank their partner in red meat markets for helping to boost pork sales. For at least a year, it’s been the most economical meat option of the big three meats (beef, pork and chicken). Consumers are still buying beef at high prices, but we can safely assume there’s some substitution effect too: for some red meat buyers, beef is simply out of reach, and they’ll substitute pork instead. Canada’s Consumer Price Index shows the largest price gains in 2024 have, in fact, come from pork, but that may not matter much to what Canadians actually buy.

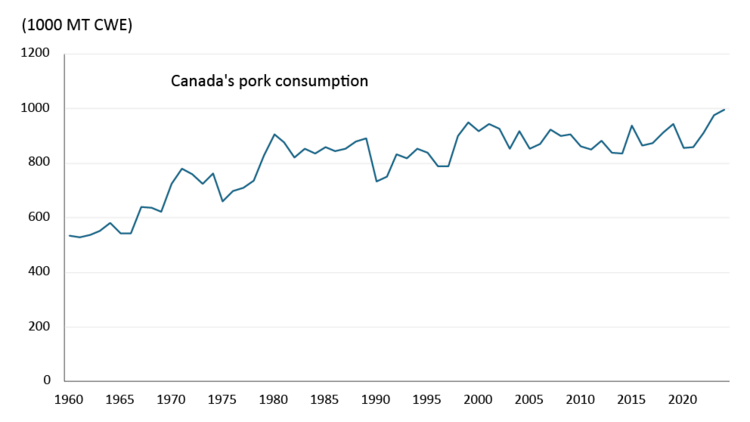

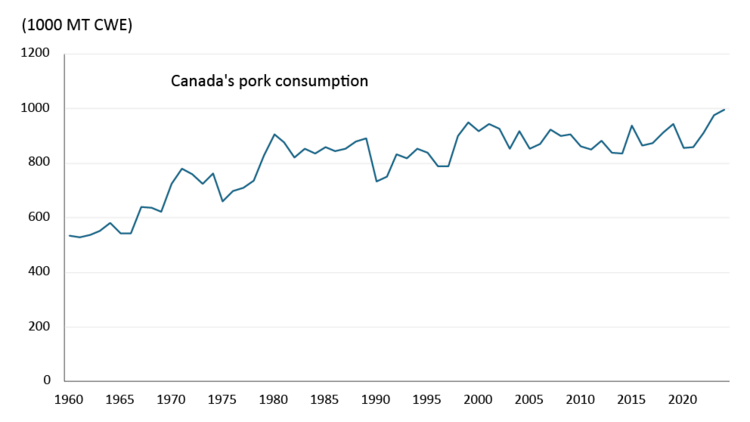

Canada has a healthy appetite for pork

Recent unprecedented population growth suggests there’ll be sustained support to further grow overall Canadian pork consumption in 2024. The USDA has pegged that at the highest level since 1960, when data became available (Figure 2). Such gains may not appear in 2024 per capita pork consumption measures though. While 2023 also saw excellent growth in those measures thanks to pork’s competitive price advantage, the new year has started off more slowly.

Figure 2: Canadian pork consumption’s upward trend shows all-time high expected in 2024

Source: USDA FAS

When population growth slows, we can expect overall consumption to slow with it, although that may happen when consumers’ budgets aren’t as pressured and interest rates and inflation are lower and more stable.

Recently weakened margins to get reprieve

While still under pressure, hog margins are now looking better than they were at the start of the year. Feed costs have fallen even faster than what we had anticipated back in January, with 2024 forecasts now tracking below the five-year average (Table 2).

Table 2: Feed costs now tracking below five-year average

| Feed costs | 2024 forecast $/tonne | 2023 average $/tonne | 5-year average |

|---|---|---|---|

| Feed barley (AB) | 270 | 350 | 280 |

| Corn (ON) | 235 | 300 | 260 |

Sources: Statistics Canada, AAFC, USDA, CanFax, CME Futures, and FCC calculations

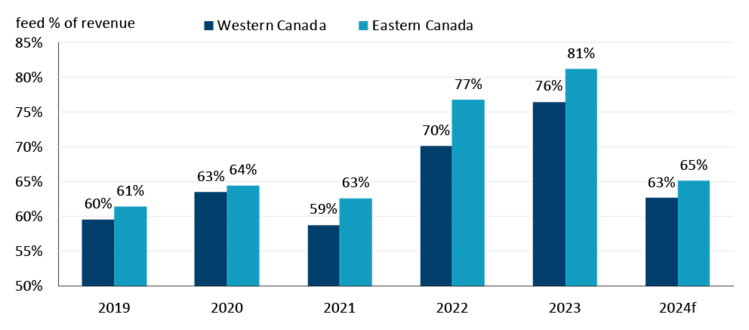

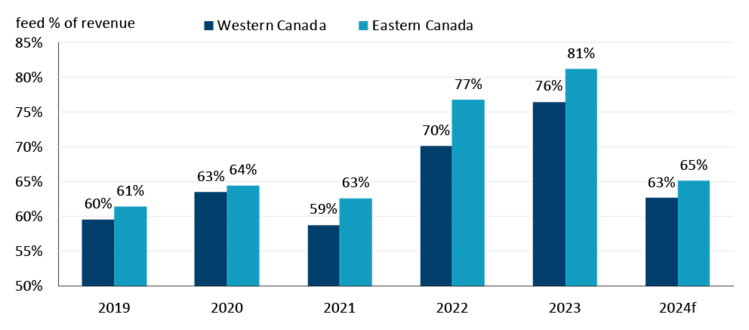

The toll that high feed costs exact from hog operations is hard to overstate. Figure 3 shows the impact of swollen costs on revenues over the last five years, highlighting the near impossibility of breaking even in 2023 when they accounted for roughly 80% of revenues. During the last two years, feed costs were extremely high while revenues were also falling. Our forecast for 2024 is a welcome return to the historical trend.

Figure 3: Feed costs as a percentage of revenues to fall in 2024

Source: Statistics Canada, Manitoba Agriculture, FCC calculations

The USDA’s recent acreage report surprised many, with forecasts pointing to higher corn acres than expected. The increase in acres combined with robust yields should further lower costs. Another potential drag on feed costs is the increasingly likely scenario of a better than average 2024 Canadian crop.

Hog processors making a comeback

Another positive for the industry is the fact that restructuring is starting to yield positive results for the country’s pork processors. Over the last few years several pork plants were closed and capacity reallocated amongst other plants. In aggregate this led to reduced slaughter capacity. In 2023, eastern Canada slaughter volumes fell -2.6% and so far in 2024, eastern Canada slaughter volumes are down -6.6% year-to-date. However, in discussing recent financial reports, executives with the country’s top pork processors have commented that pork markets are starting to show improvement with profitability returning to the sector.

Bottom line

The first half of 2024 gives reason to be more optimistic about the outlook for the hog supply chain. Eased pressures on margins will come in the way of better prices and reduced costs.

However, the hog production sector still faces significant risks, particularly coming from abroad. The U.S. plan to limit foreign pork supplies in their domestic market under the new country-of-origin labelling regulations (COOL) established in March 2024 could toss a significant wrench into the works. The new COOL restrictions would indicate to consumers where a hog was born, raised and processed. They would likely increase costs for Canadian suppliers, and could even work to keep Canadian-born animals out of the U.S. hog-to-pork supply chain. That has potential to matter north of the border where a lot of pork processing has already been lost and is not yet set to return.