Highlights:

- DCE Hog Futures lower in the first week of March with reduced trading activities;

- Hog futures price shows a pattern of negative correlation with cash hog price;

- Correlation between hog price and stock price of large hog firms is statistically significant;

- Hog Price Cycle is the systemic risk “beta” for hog industry investment.

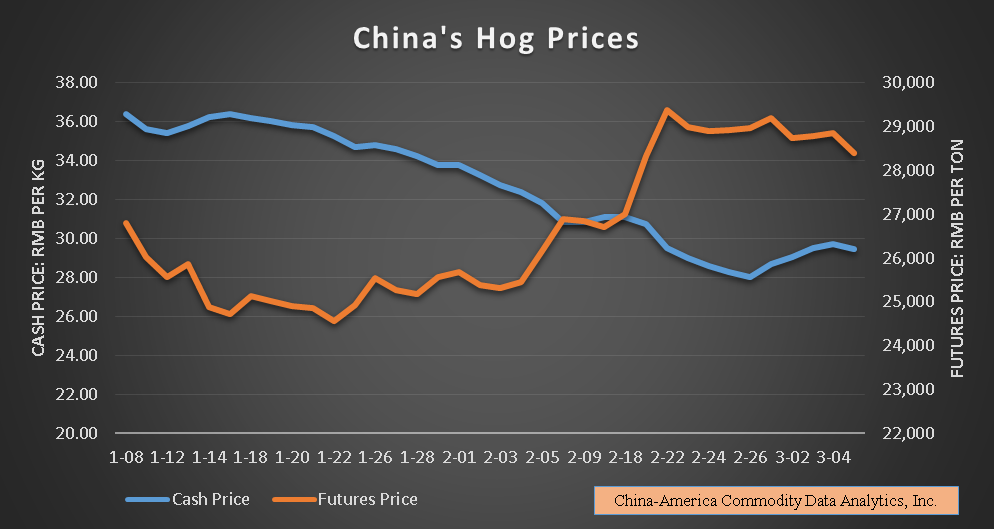

[Greene County IL, Mar 8] After a strong showing in February, China’s Live Hog Futures softened in the first week of March with low trading volume.

DCE Live Hog vs. CME Lean Hog

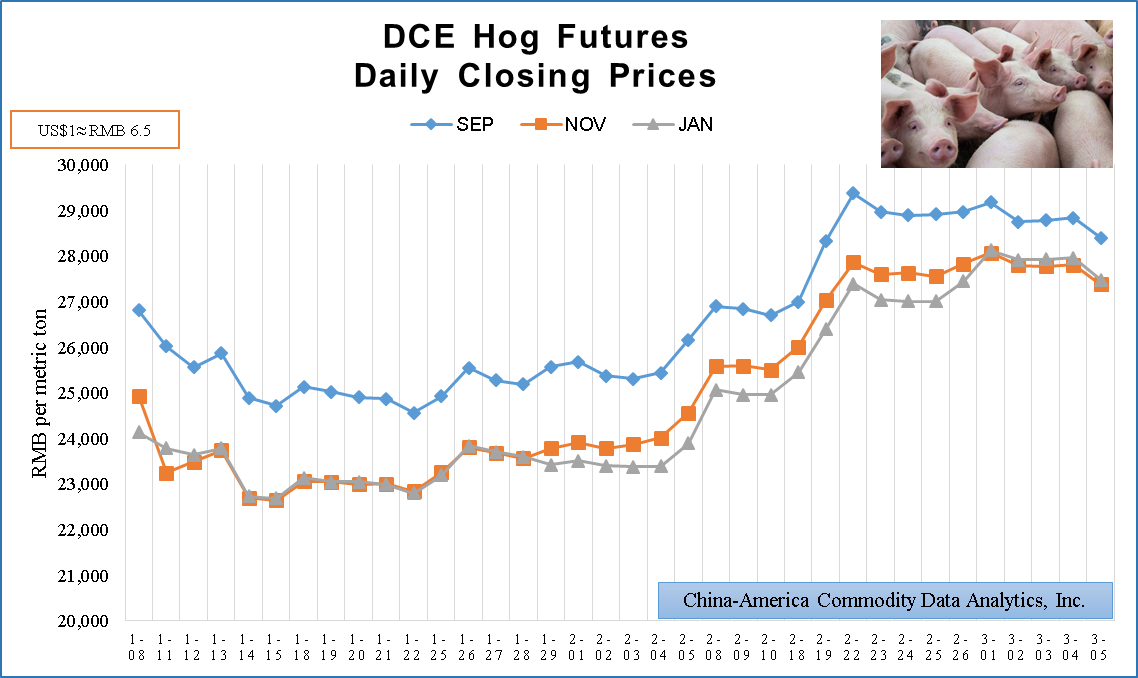

The front month September contract LH2109 closed at 28,400 on Friday March 5th, down 1.5% from previous day and -2.0% from one week ago. November contract LH2111 shaved off 1.6% both for the day and for the week, and ended at 27,380. January contract LH2201, which will expire around next year’s Chinese New Year, also lost 1.8% and closed at 27,480. (Notes: DCE hog futures is based on 16 metric tons of live hogs. Price unit is RMB yuan per metric ton, US$1≈6.5 yuan.)

DCE live hog September futures price of 28,400 is equivalent to US$4.37 per kilogram, or 198.4 cwt. For comparison, CME lean hog August contract settled at 95.325 last Friday.

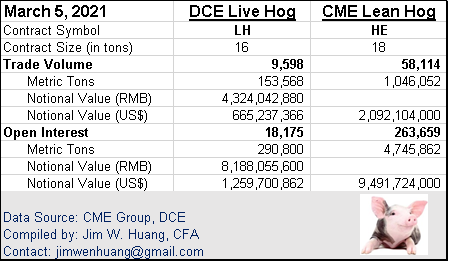

Average Daily Volume is 6,818 contracts month-to-date, down 38% from February ADV of 10,977. Open Interest on March 5th was 18,175 lots, down 10.4% from the end of February. On Friday, CME lean hog traded 52,626 lots, with open interest standing at 263,659 contracts.

The table below illustrates an apple-to-apple comparison of DCE live hog and CME lean Hog. In notional terms, DCE hog futures volume was $665 billion, with open interest at $1.26 trillion. CME hog futures market was about 3 times its size in volume and 8 times as big in open interest.

China’s Cash Hog Market vs. Futures Market

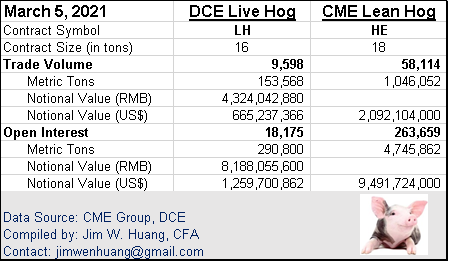

China’s hog price has been declining since the beginning of the year. Based on CACDA data, national average live hog price dropped nearly 9 yuan (-23%) to a seasonal low of 28.04 per kilogram on February 26. As factories and schools reopened after the Spring Festival holidays, pork demand increases and cash price inches up to 28.90 today. Based on dollar/yuan exchange rate of 6.5, China’s live hog price is US$4.45 per kilogram, or $202 in cwt. This compares to US carcass base price of $81.04 on March 5, reported by the USDA.

In the two months since its debut, DCE hog futures shows a price pattern negatively correlated to the cash hog price. The logic follows this: 1) Decline in cash hog price induces farmers to accelerate hog sales; 2) Increase in hog supply puts further downward pressure on cash hog price, and causes more panic sales; 3) Continuous price fall shakes up long-term price outlook, and induces sow liquidation; 4) Decrease of sow stock reduces future supply of market hogs, pushing up futures price.

According to the State Statistics Bureau, in 2019, about 48% of the hog production comes from farmers with annual output of fewer than 500 hogs. And 36% is from those with 500-50,000 hogs. Large producers with over 50,000 annual hog sales account for less than 15%. There were 26 million hog farms in 2019, down from 61.7 million in 2014.

In my opinion, to understand how hog producers make their production decisions, behavior finance would do a better job comparing with rational economic models. While hog futures market would impact large producers, small hog farmers still mainly react to cash hog prices.

Correlation Study: Hog Price and Stock Price

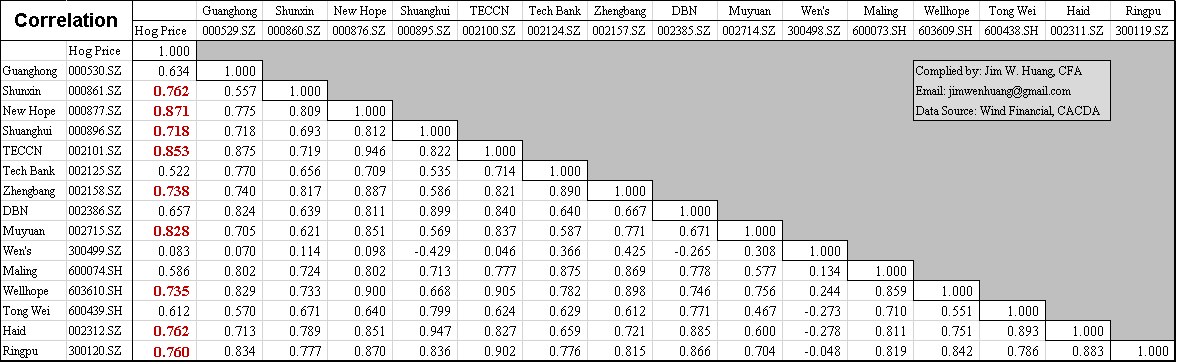

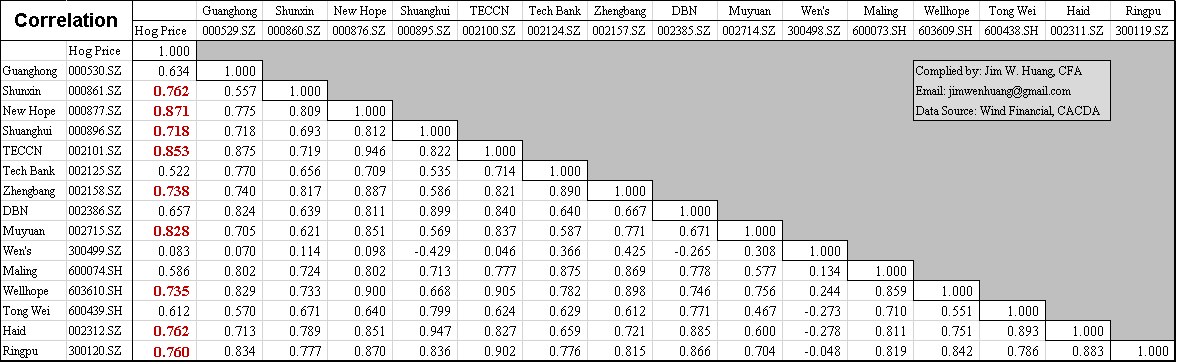

I recently conducted a correlation study of China’s cash hog price and stock price of the hog firms publicly traded in China’s stock market.

My data series cover 38 months from January 2018 to February 2021. This period includes seven months of a “normal market” prior to the African Swine Fever pandemic, one year and a half of intense impact from the ASF outbreak, and about one year of hog industry in recovery. There were 759 trade days when China’s stock market opens, and 1,146 when CACDA obtains cash hog prices, which include all weekends and most holidays.

This study shows that correlation between cash hog price and daily closing stock price of publicly traded hog firms is statistically significant.

Stock price of three hog firms have a correlation greater than 80%, including New Hope Group (000877.SZ) , China’s largest feed processor at 0.871; TECCN (002101.SZ), an animal health company at 0.853; and Muyuan (002715.SZ) , the No. 1 hog producer in China at 0.828. It is interesting to note that the strong price correlation occurs in all major sectors of the hog industry.

Six company stocks have correlation with hog price above 70%, including Shunxin (000861.SZ) at 0.762; Shuanghui (000896.SZ), 0.718; Zhengbang (002158.SZ), 0.738; Wellhope (603610.SH), 0.735; Haid Group (002312.SZ), 0.762; and Ringpu (300120.SZ), 0.760.

Three hog stocks have correlation above 60% and three more about 50%. Wen’s Group (300499.SZ) is the only outlier. Formerly the largest hog and poultry producer in China, Wen’s suffered severe losses due to ASF, watching its hog production volume and stock market value both cut in half. Wen’s stock price has a correlation of 0.083 with hog price, basically showing no correlation at all.

Interpretation: Hog Price is a “Market Beta” Risk

In stock investment theory, we could separate active investment returns from market related returns using this model: Alpha = R – Rf – beta (Rm-Rf).

In the above formula, R is the stock return. Rf is the risk-free rate, such as US Treasury, Rm is market return, such as a broad stock market index like S&P 500.

Beta (β) is the sensitivity of stock price related to the broad market index. Alpha (α) is the portion of stock return due to superior performance of the company relative to its peer. From investor’s point of view, Alpha is the stock picking skills attributable to active investment management.

We could apply this investment theory to the RMB 1.6 trillion Chinese Hog Stock Market Sector, which includes the 31 publicly traded large hog firms with a combined market valuation of US$250 billion.

Hog Price Cycle is a well-known risk in the hog industry, and it is more pronounced in China comparing to the US. All industry participants are vulnerable to the 3-5 year roller coaster of hog price cycle. If we use stock price as a measure for investment return on large hog firms, we could say that Hog Price is a market beta risk common to all hog sector stocks. In other words, hog price is a systemic risk outside the control of individual firm or investor. The correlation data value indicates the various degrees each company stock responds to hog price changes.

My adjusted formula Alpha = R – Rf – beta (Rhp-Rf), replaces market return Rm with Rhp, the return of cash hog price. Let’s see what a difference it makes.

Three years ago, China’s Shanghai Stock Index was at 3,259.41. Today, it closed at 3,421.41. If you broadly invested in China’s stock market, your total returns for three years is 4.97%. Annualized return is a meager 1.63%. Let’s use China’s 3-year Treasury note as our risk-free rate, which currently trades at 2.898%. You could see that index investing in China’s stock market is not an appealing idea. You would generate a negative return of 1.27% after subtracting the risk free rate.

In the hog sector, we are looking at an entirely different picture. During the same period, cash hog price jumped from RMB 11.43 to 29.46 per kilogram, a whopping 158% gain. If you could buy an investment instrument replicating hog price, you would have realized an annualized compound return of 37%! Rhp-Rf is a 34.2% in this case.

Correlation of stock price and hog price will be our beta in the model. If you invest in a hog company stock 70%-80% positively correlated to cash hog price, you could measure the company specific performance separately from hog price trend using our adjusted formula.

Portfolio managers usually use stock index futures to hedge risks related to the broad market. Taking a step further, could we use Hog Futures to hedge hog price risk in hog stock investment?

Next month, I will team up with StoneX Group to provide a free webinar, titled “China impact on US pork industry”. I would explore some of these ideas there. Official announcement of the webinar shall come out next week.

Happy International Women’s Day!

Disclosure: The author does not own any stock discussed in this writing.

About the author: Jim W. Huang, CFA is chief executive of China-America Commodity Data Analytics, Inc., an independent agricultural commodity market consultancy. Mr. Huang is a leading voice on China’s livestock and poultry markets, and frequently quoted by Bloomberg, Reuters and the Wall Street Journal. Prior to starting CACDA in 2012, he was an Associate Director of Product Strategy at CME Group, the world’s largest Derivative Exchange holding company. Mr. Huang received an MBA from Chicago Booth and studied under Nobel Laureate Eugene Fama in an empirical research of futures market liquidity. You may contact the author by email at jimwenhuang@gmail.com.

If you would like to receive China Hog Market Weekly Commentary directly, please send an email request to the author with your email address.