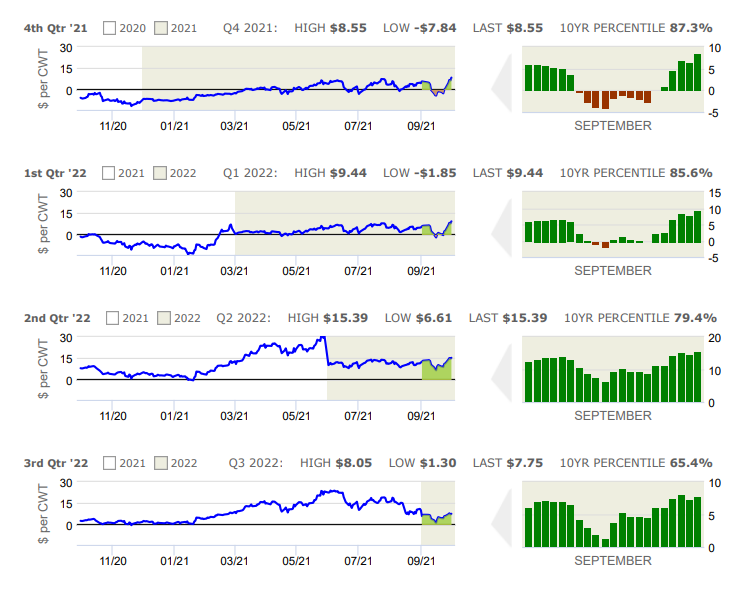

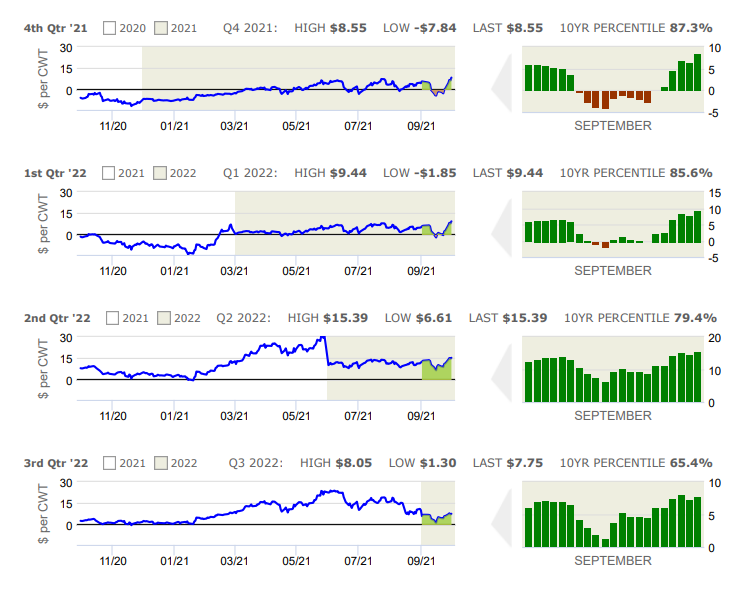

Margins strengthened over the second half of September as hog prices surged following a bullish quarterly Hogs and Pigs report while feed prices were steady to weaker as quarterly grain inventories were larger than anticipated. USDA shocked the market by reporting hog

inventories well below trade expectations, with the supply of all Hogs and Pigs on September 1st at 75.352 million head, down 3.082 million or 3.9% below last year when the market on average was anticipating a reduction of 1.7% from 2020. This implies a much different supply outlook for the upcoming winter season and is helping to support margins on the front end of the curve. In addition to the total supply of hogs, the breeding herd was pegged at 6.19 million head on September 1, down 2.3% from last year and about 70,000 below the average of analysts’ expectations. The September breeding herd was also 0.6% below the June figure, the first time this has happened since 2013 which

coincidentally corresponds to a similar fundamental backdrop of high feed costs. The USDA also made significant revisions to previous inventory estimates, lowering the pig crop for the Dec-Feb period by 1.292 million head or 3.9% – one of the largest revisions on record. The revision reflects the lower-than-expected hog slaughter during the June-August quarter with many pointing to the impact from the new variant of PRRS last winter. USDA also reported Sep 1st corn stocks of 1.24 billion bushels, down 36% from last year but about 69 million bushels above the average of trade estimates and on the high end of the range of expectations. Soybean stocks of 256 million bushels were also well above trade expectations, with more pressure on meal following the report relative to corn. Our clients have benefited from recent adjustments on hog hedges to allow for more upside and are now scaling into new margin protection in deferred marketing periods.

The Hog Margin calculation assumes that 73 lbs of soybean meal and 4.87 bushels of corn are required to produce 100 lean hog lbs. Additional assumed costs include $40 per cwt for other feed and non-feed expenses.