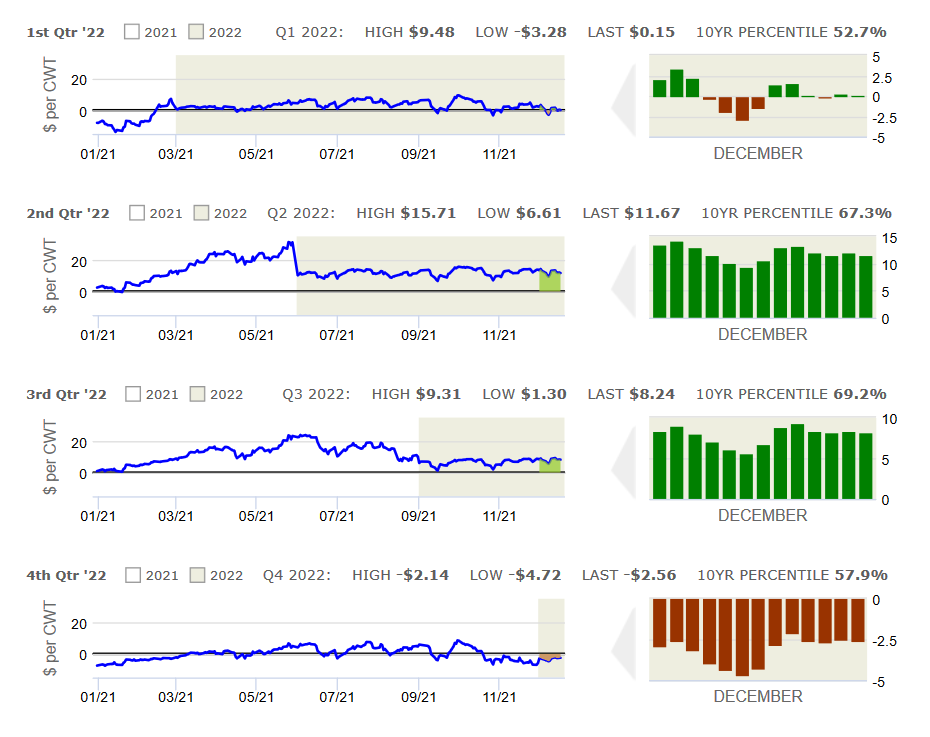

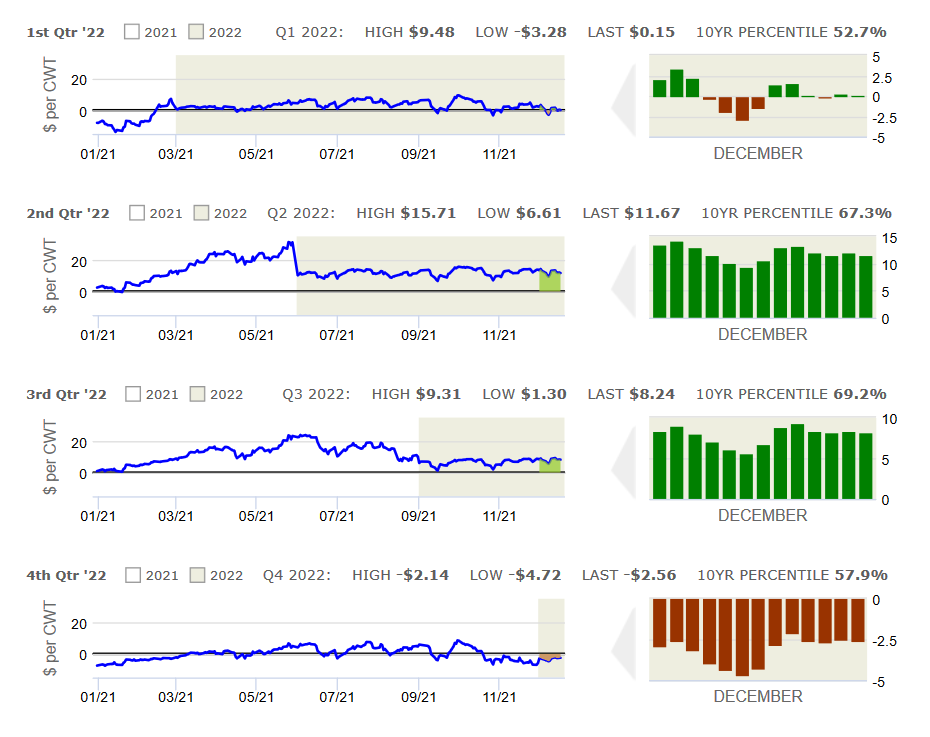

Margins were weaker over the first half of December on a combination of lower hog prices and higher projected feed costs. While futures prices have been steady to slightly weaker recently, pork demand generally remains quite strong. Pork export shipments last week of 30,102 MT were down 9.8% from the prior four-week average but still a solid figure. Exports to China are only a fraction of what they were at this time last year, although Mexico has helped to fill in the void to some extent. Compared to last year, pork export shipments this past week were down 28% but to China specifically, 67% lower than this same week in 2020. It will not help that China is reverting pork tariffs to their prior

levels before the ASF outbreak now that domestic supplies have recovered. For most countries, the tariff will now be 12% compared to 8% previously, but for the U.S., the tariff will now rise to 37% from 33%. In terms of domestic demand, the retail pork price continued to climb in November, rising for the 8th consecutive month to $4.82/lb. up 17.7% from October. All eyes will be on the USDA’s Quarterly Hogs and Pigs report later this month which will provide greater insight into hog supplies for 2022, with particular focus on the breeding herd after the surprise drop in September from the June inventory. Corn prices continue to trade sideways but remain supported by strong demand in the ethanol sector along with ongoing concerns over soaring fertilizer prices and dryness in South America tied to La Nina. New-crop corn prices are likewise receiving support from the need to compete for acreage with other crops including soybeans, spring wheat, oats and cotton. Our clients continuing looking for opportunities to add margin protection in deferred periods with flexible strategies that allow for further margin improvement while evaluating adjustments on existing positions.

The Hog Margin calculation assumes that 73 lbs of soybean meal and 4.87 bushels of corn are required to produce 100 lean hog lbs. Additional assumed costs include $40 per cwt for other feed and non-feed expenses.