Agricultural credit conditions remained strong in the second quarter, but slower improvement was expected in the coming months.

Agricultural credit conditions remained strong in the second quarter, but slower improvement was expected in the coming months. Farm income increased further according to respondents of the Federal Reserve Surveys of Agricultural Credit Conditions, but the pace of increase slowed from recent quarters and further softening was expected going forward. Farm loan repayment rates continued to strengthen, but the pace of improvement also slowed. Following nearly two years of acceleration, farmland values also showed signs of moderating as interest rates increased more notably.

Strength in farm finances continued to support a positive outlook for agricultural credit conditions through the remainder of 2022, but risks to the farm economy have become more notable. Crop and livestock prices remained elevated, but have been volatile in recent months alongside ongoing uncertainty about the outlook for supply and demand of some major commodities. With substantial increases in production costs over the past two years, profit margins for many producers could be pressured with a sizable decline in commodity prices. Despite growing risks, balance sheets for most producers remained strong and profit opportunities during 2022 remained well in reach.

Second Quarter Federal Reserve District Ag Credit Surveys

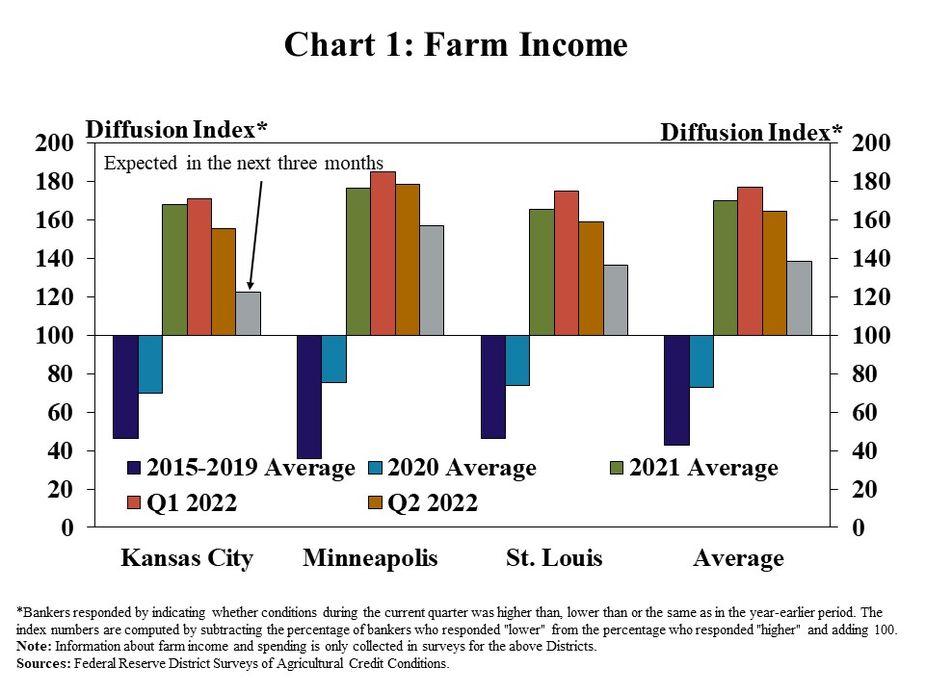

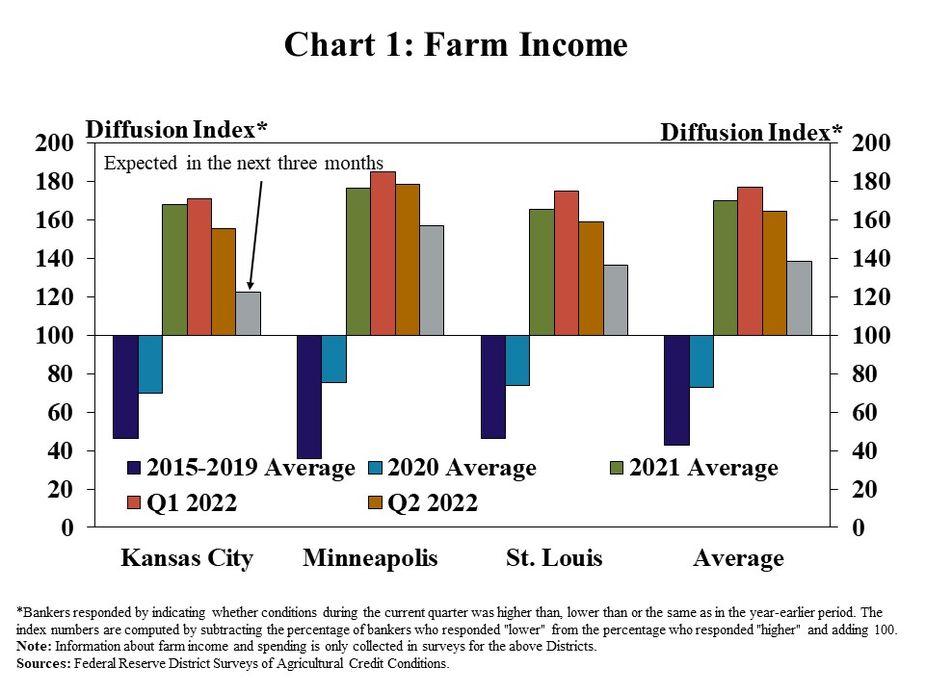

Farm income remained strong in the second quarter, but slower growth was anticipated during the months ahead in some areas. The majority of banks responding to the Federal Reserve Surveys of Agricultural Credit Conditions continued to report that farm income was higher than a year ago, but the share dropped modestly from recent quarters in the Kansas City and St. Louis regions (Chart 1). Alongside intensifying pressures from rising input costs, the share of respondents expecting incomes to continue increasing in the coming months was notably lower.

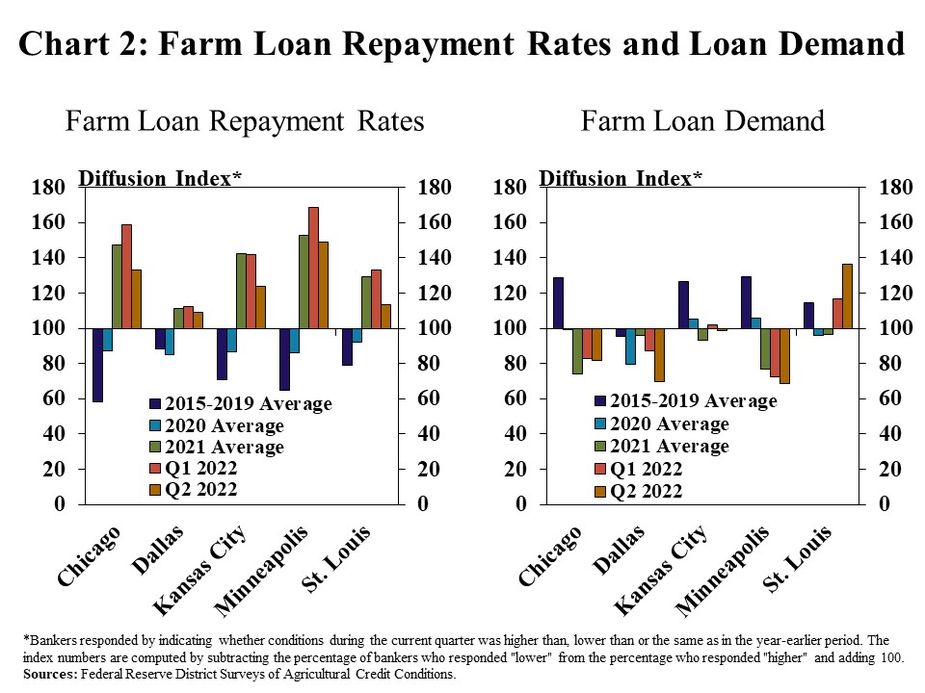

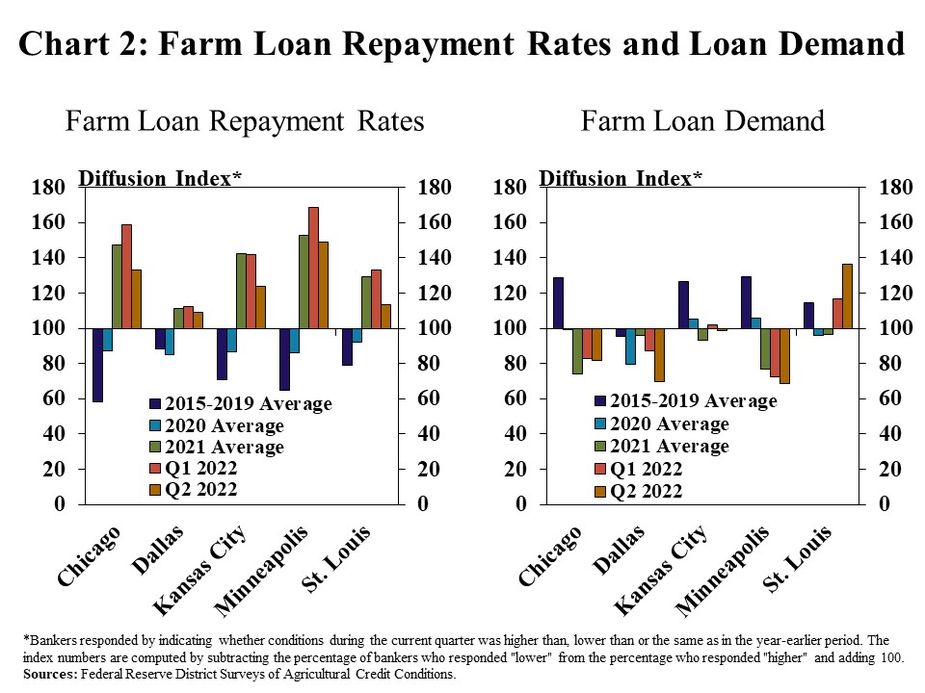

Similar to farm income, credit conditions also remained strong, but the pace of improvement slowed. Farm loan repayment rates continued to increase steadily in the second quarter, but a smaller share of banks reported that repayment was higher than a year ago (Chart 2, left panel). Demand for non-real estate farm loans remained subdued in all regions except the St. Louis District as strong farm finances provided ongoing support to working capital (Chart 2, right panel).

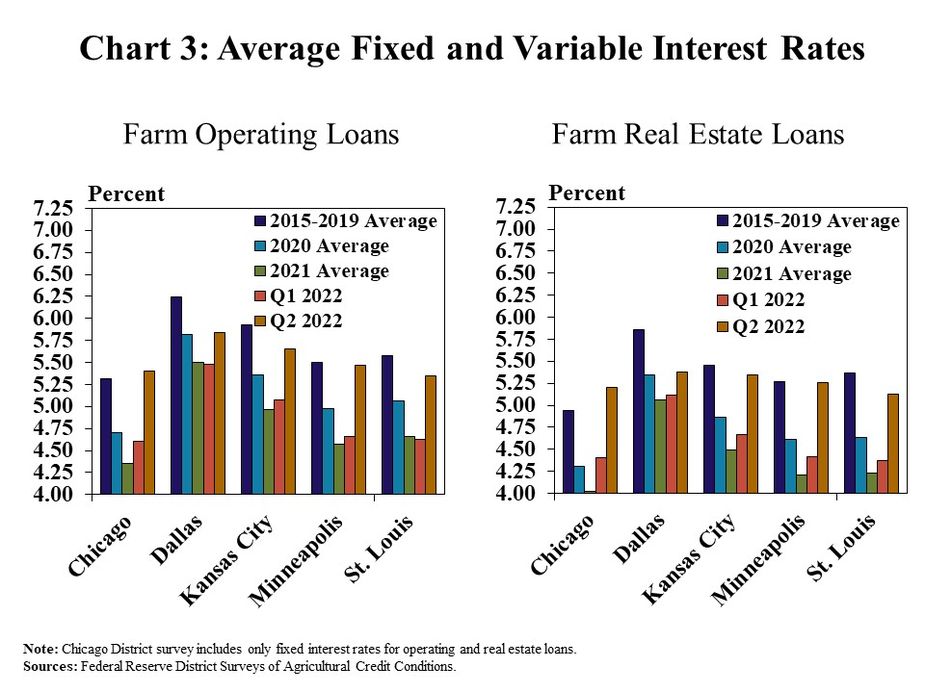

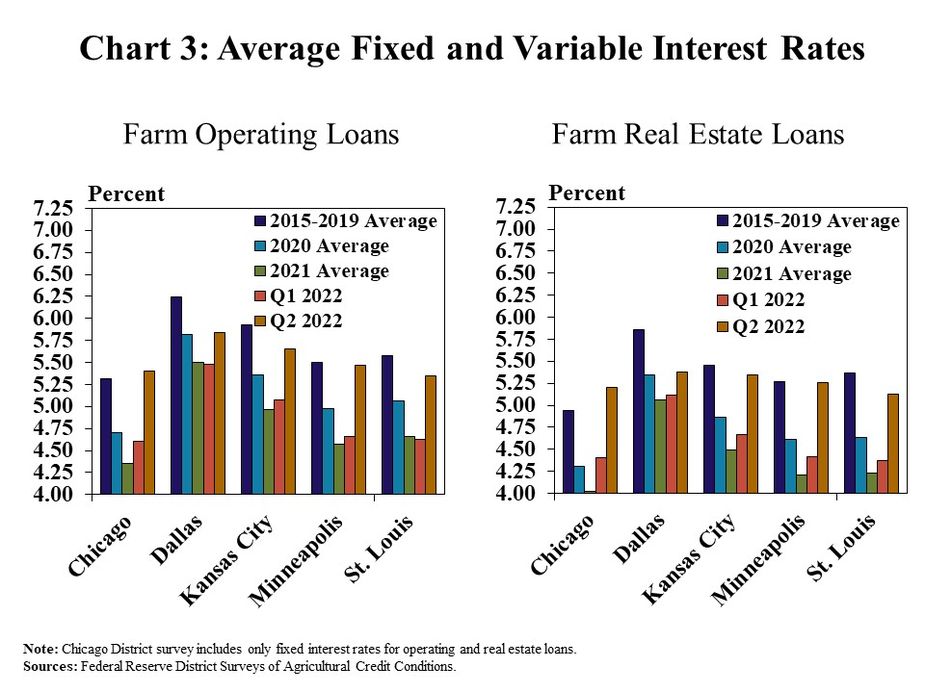

Interest rates on agricultural loans jumped higher alongside recent increases in benchmark rates. Following a 125-basis point rise in the Federal Funds Rate since the prior survey period, interest rates on farm real estate and operating loans rose by an average of nearly 70-basis points from last quarter (Chart 3). Average rates reached the highest level since 2019 across all regions and fixed rates surpassed the average from 2015-2019 in the Chicago District.

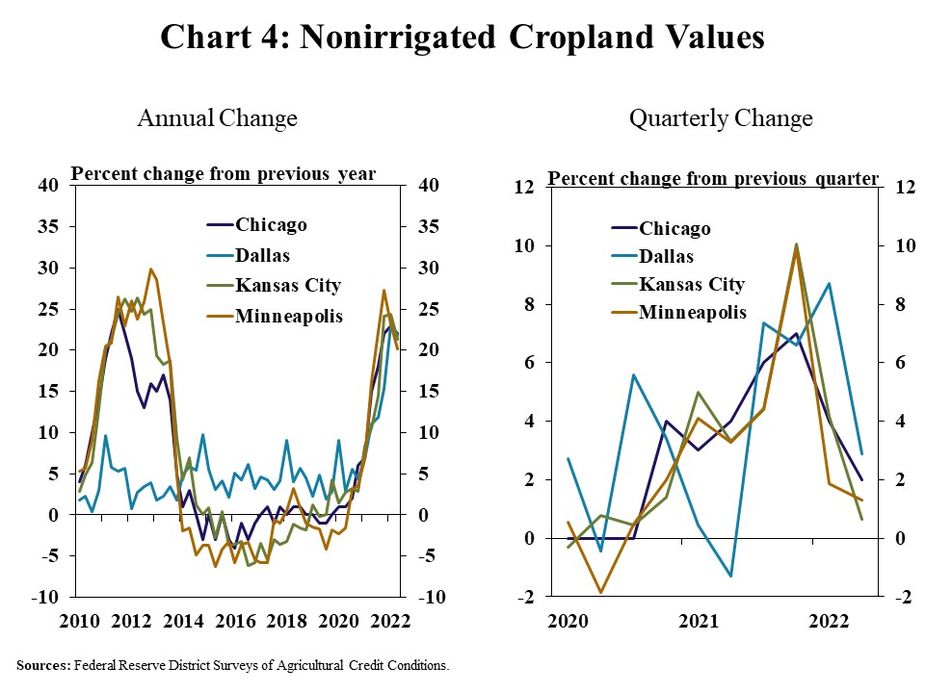

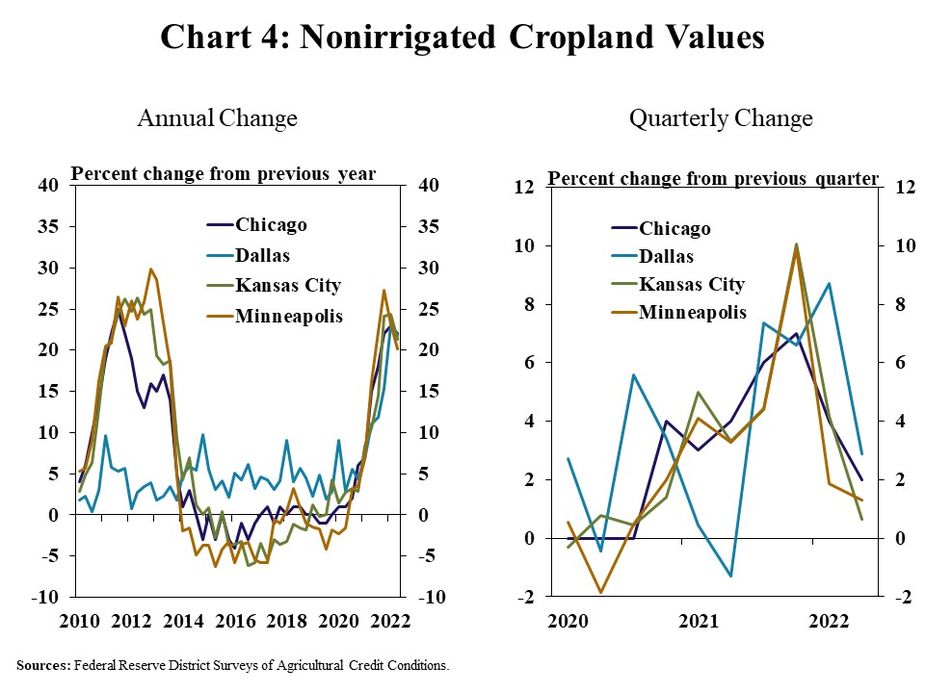

Alongside the uptick in interest rates and signs of softening in the farm economy, the acceleration in agricultural real estate values abated. The value of nonirrigated cropland was about 20% higher than a year ago across participating areas, which was a slower pace of increase than last quarter and followed two years of quickening growth (Chart 4, left panel). Land values grew by an average of about 2% from the previous quarter, which was the slowest pace of increase since early 2020 (Chart 4, right panel).

Data and Information

Excel SpreadsheetFederal Reserve Ag Credit Surveys Historical Data