Interest rates on farm loans increased sharply in the third quarter and the acceleration in farm real estate values continued to ease. Farm income and credit conditions remained solid, but the pace of improvement softened. The financial impact of drought also intensified, particularly in the southern and western portions of the District. Despite recent headwinds, farm finances remained strong and continued to support sound agricultural loan performance.

The outlook for the agricultural economy generally has remained positive despite a recent pull back in prices of some key farm commodities. Volatility in crop markets, higher expenses and drought could hinder incomes for some producers, but prices of key crops and livestock remained at multi-year highs and profit opportunities across the farm sector remained favorable. The substantial improvement in farm finances and a surge in agricultural real estate values over the past two years have also bolstered balance sheets and continued to provide ongoing support to many operations.

Interest Rates and Farmland Values

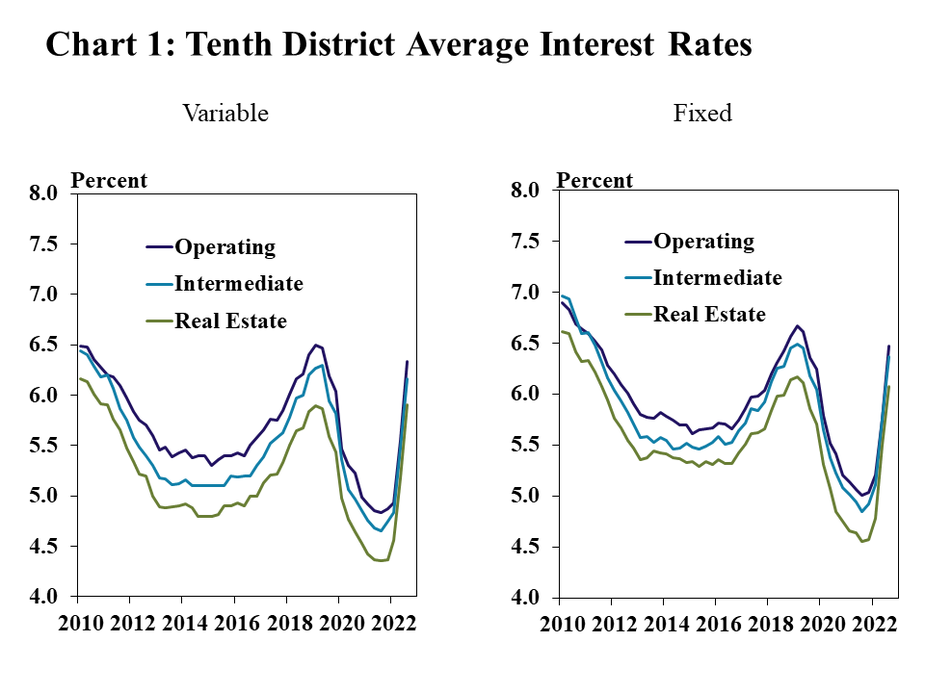

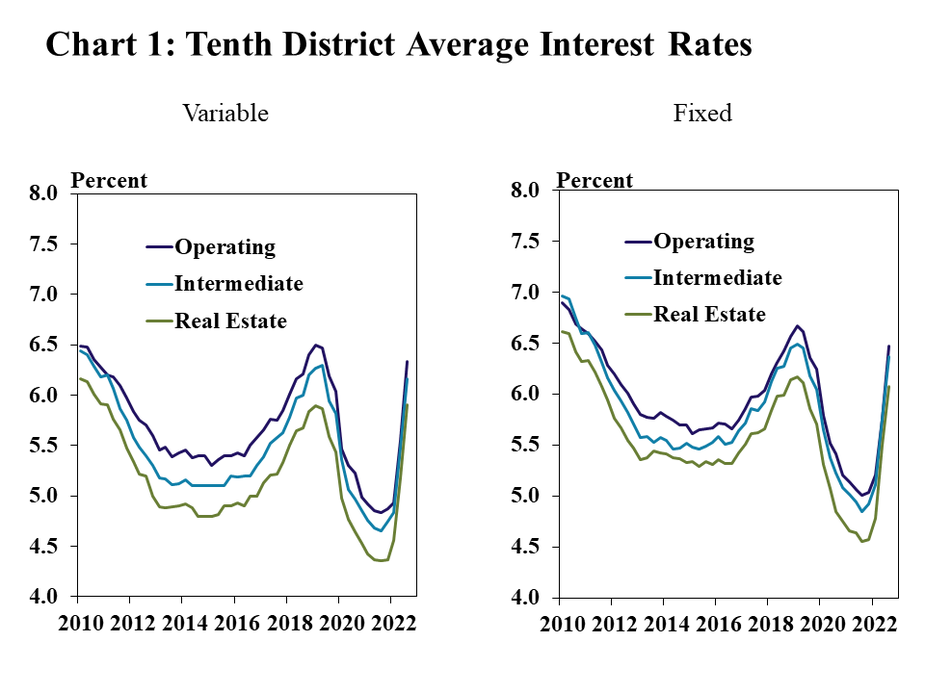

The average rate charged on farm loans rose rapidly alongside higher benchmark rates. Variable and fixed rates on all types of loans were about 75 and 65 basis points higher than last quarter, respectively (Chart 1). Farm banks have increased rates alongside the historically sharp rise in the federal funds rate and financing costs for farmers have reached the highest level since 2019.

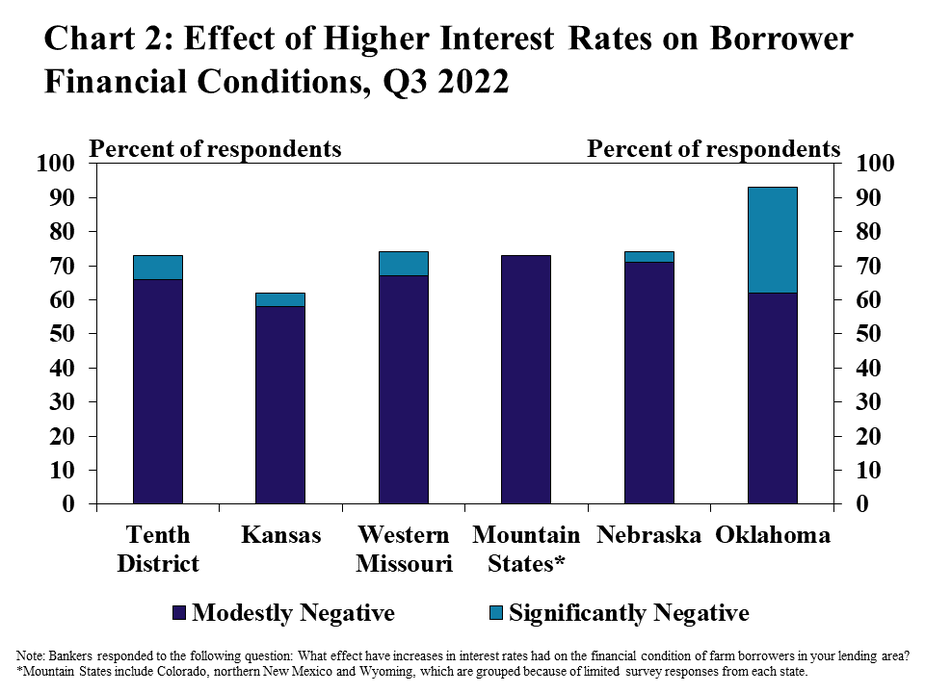

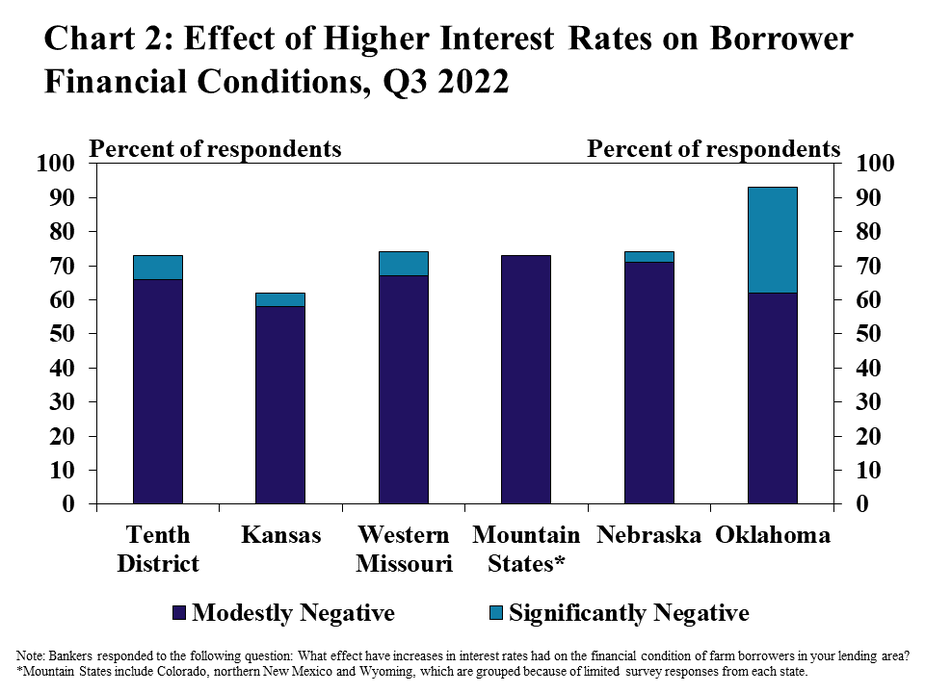

Higher interest rates have had a direct impact on farm borrowers according to lenders. About two thirds of respondents in the District indicated that higher interest rates had a negative effect on financial conditions for borrowers (Chart 2). Banks in Oklahoma noticed the most pronounced impact, with about a third reporting a significant negative effect.

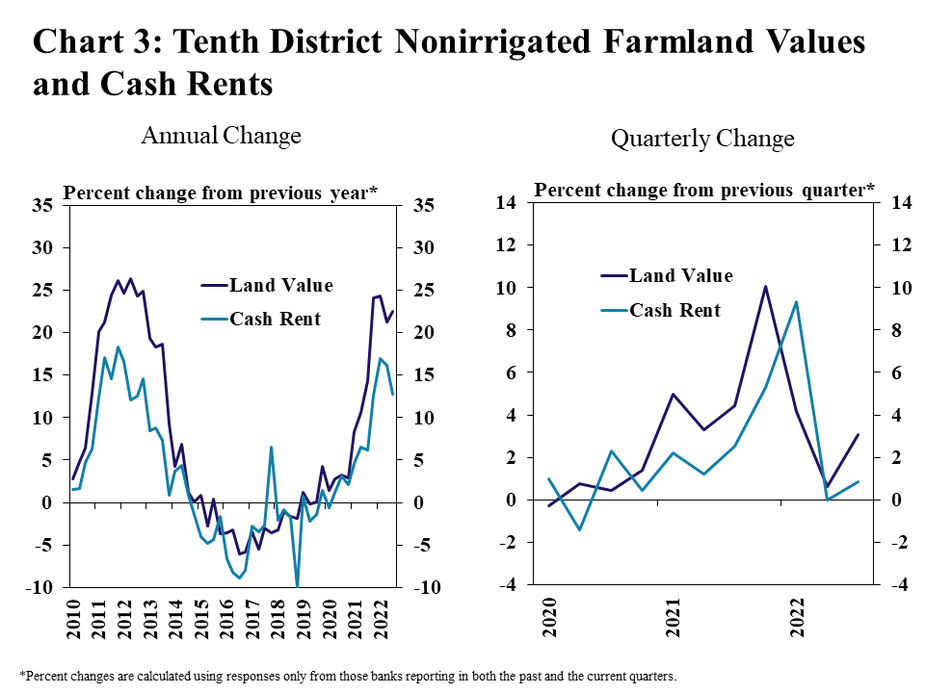

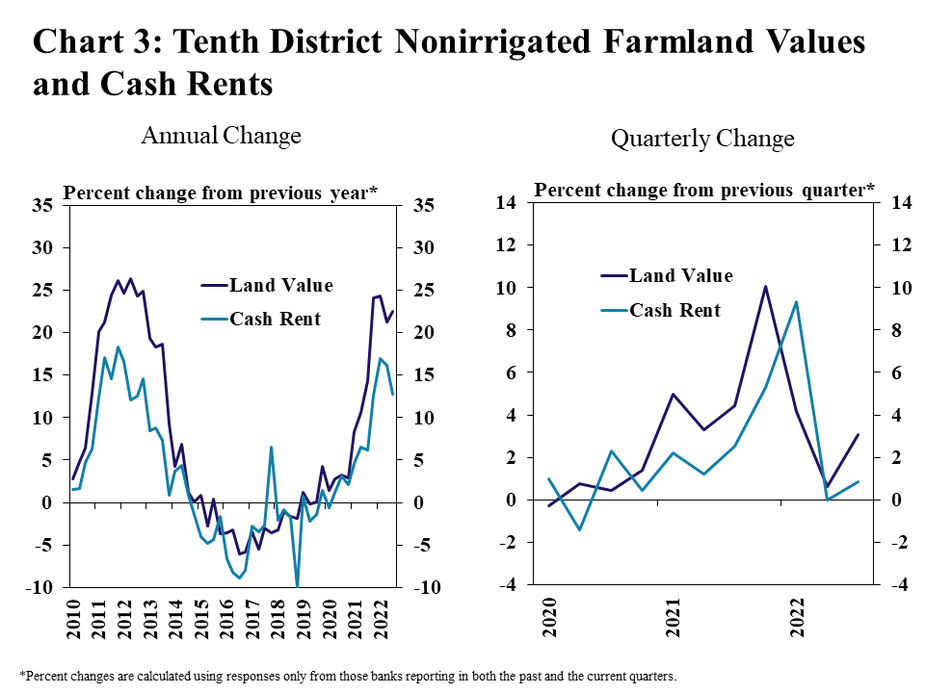

As interest rates increased, growth in farm real estate values showed more signs of softening. The value of nonirrigated farmland increased about 23% and 3% from the previous year and quarter, respectively (Chart 3). The pace of growth has moderated following steep acceleration in 2021 and cash rental rates have also followed a similar path.

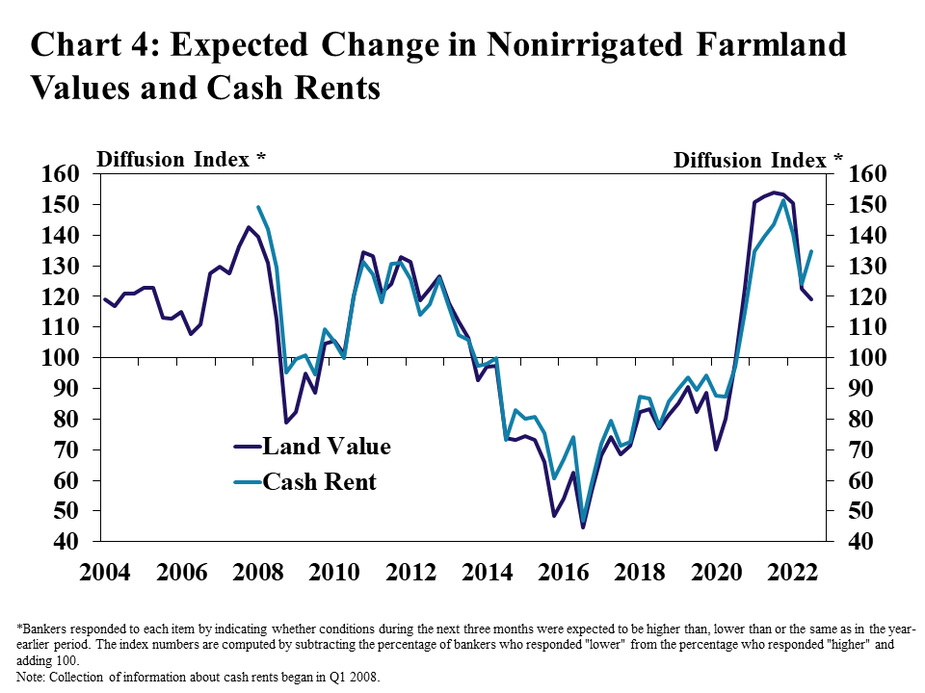

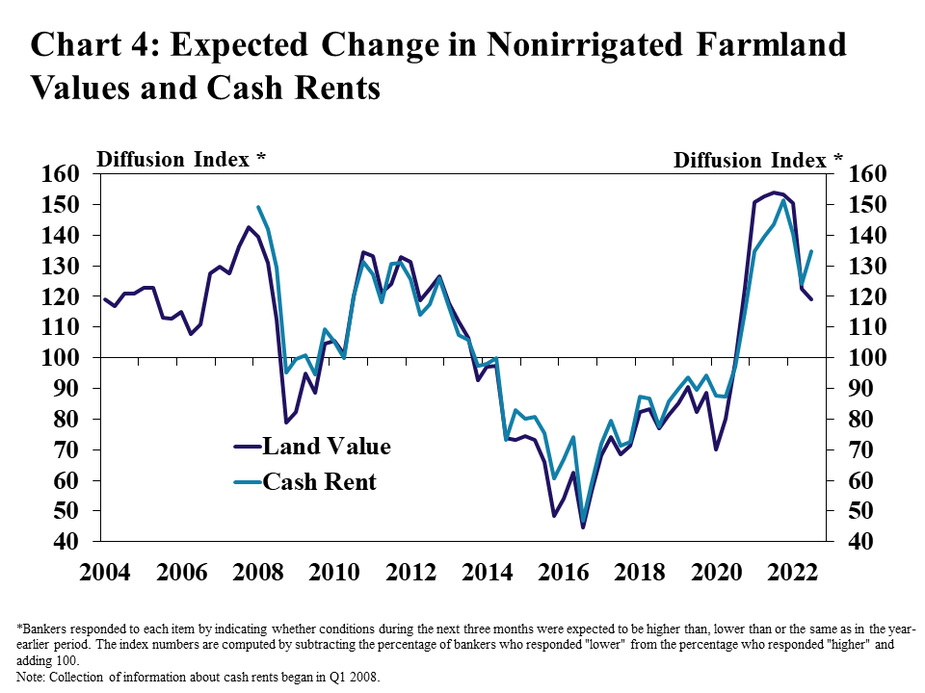

Additional growth in farmland values and cash rents was still anticipated in the coming months, but the expected pace of increase continued to moderate. About 30% of banks expected farmland values to increase in the next quarter compared with a year earlier, down from about half of respondents expecting future increases throughout 2021 (Chart 4). The share expecting higher cash rents increased slightly from last quarter, but also remained below the average of 2021.

Farm Finances, Credit Conditions and Drought

Farm finances remained strong, but increases in income and liquidity were less pronounced than recent quarters. As the price of several major commodities declined from recent highs, farm income increased at a notably slower pace and borrower liquidity was steady compared with a year ago (Chart 5). Looking ahead, income was expected to remain unchanged and cash flow was expected to weaken slightly.

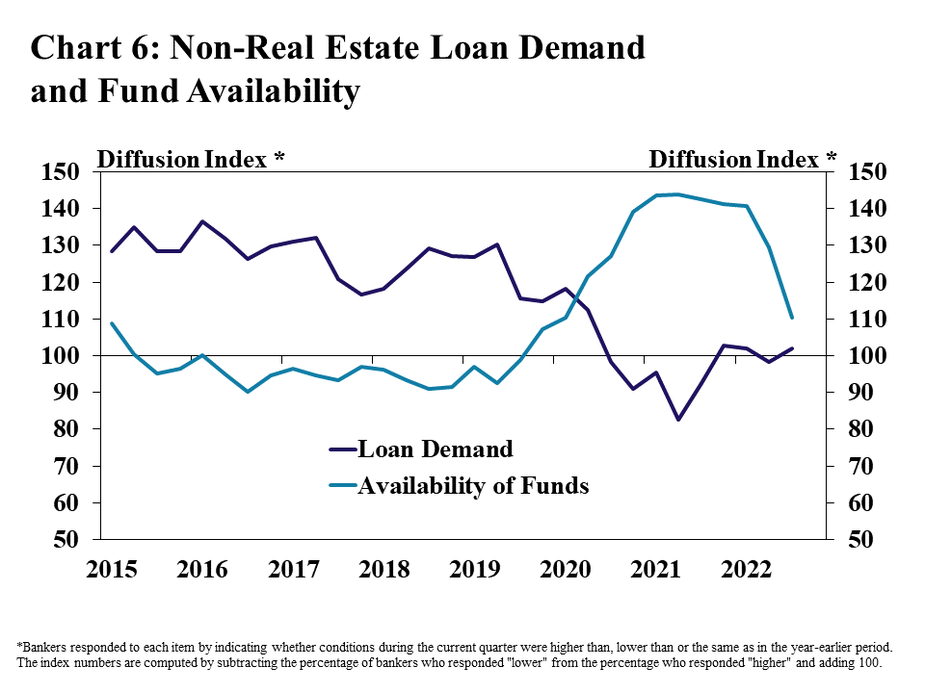

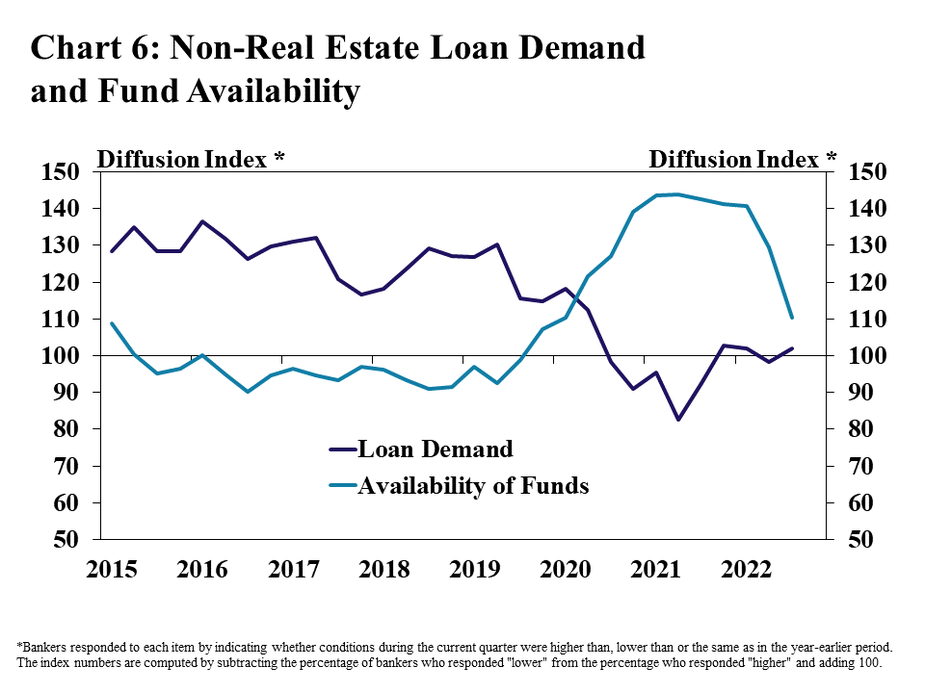

Increases in fund availability slowed alongside moderation in borrower liquidity and steady loan demand. Demand for non-real estate farm loans was nearly unchanged from a year ago, with about 30% of banks reporting higher demand and 30% reporting demand was lower (Chart 6). After surging alongside an influx of deposits the past two years, availability of funds has increased at a notably slower pace in recent quarters.

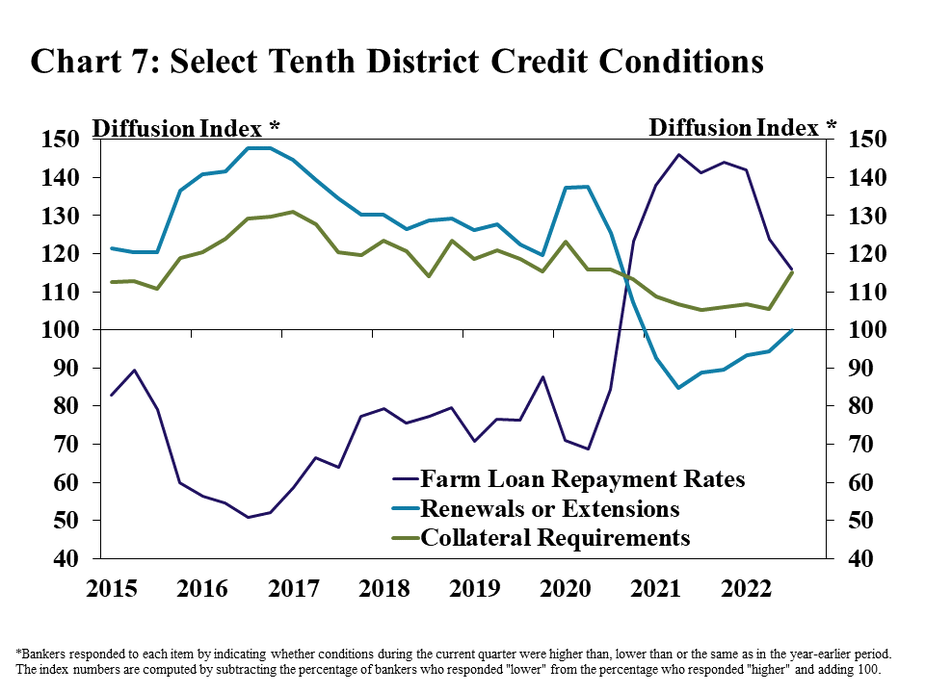

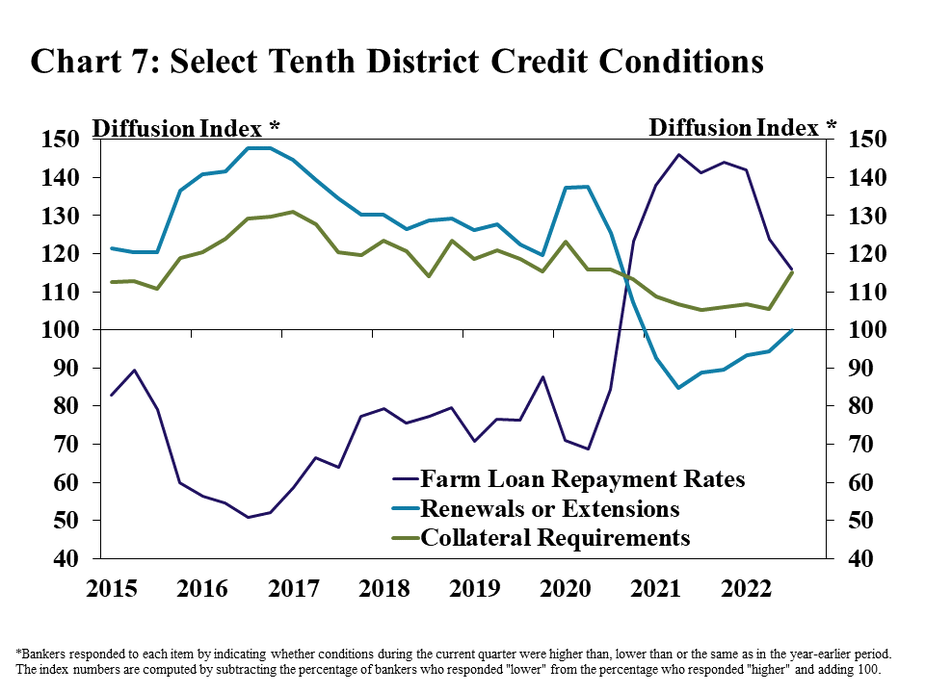

Similar to farm income, key measures of credit conditions remained strong, but improvements were more limited in the third quarter. Farm loan repayment rates continued to increase, but the pace of improvement slowed (Chart 7). At the same time, collateral requirements increased at a slightly faster pace than recent quarters and renewal and extension activity moderated following more than a year of declines.

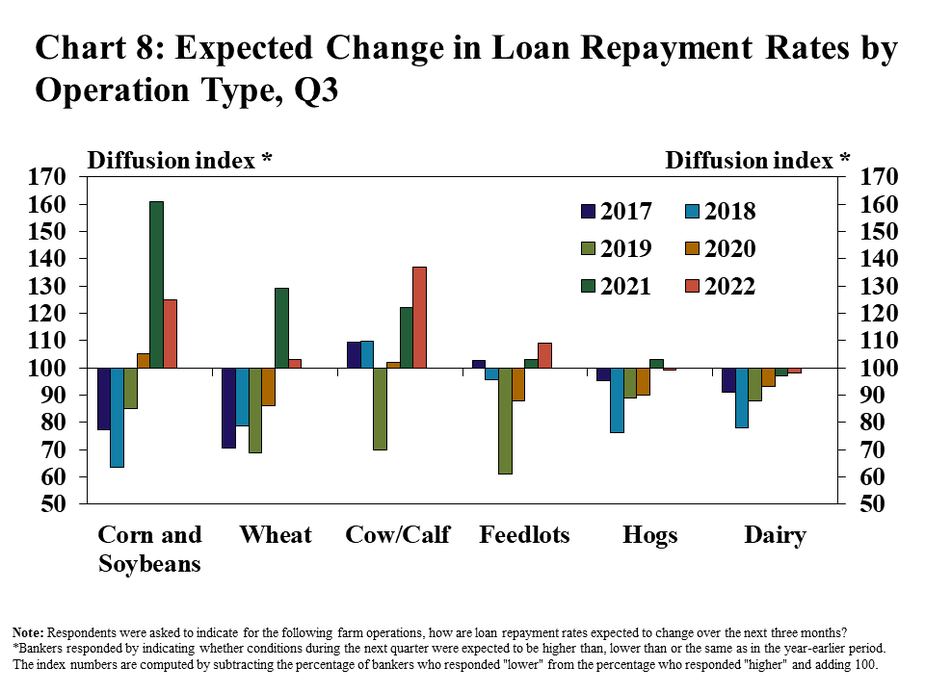

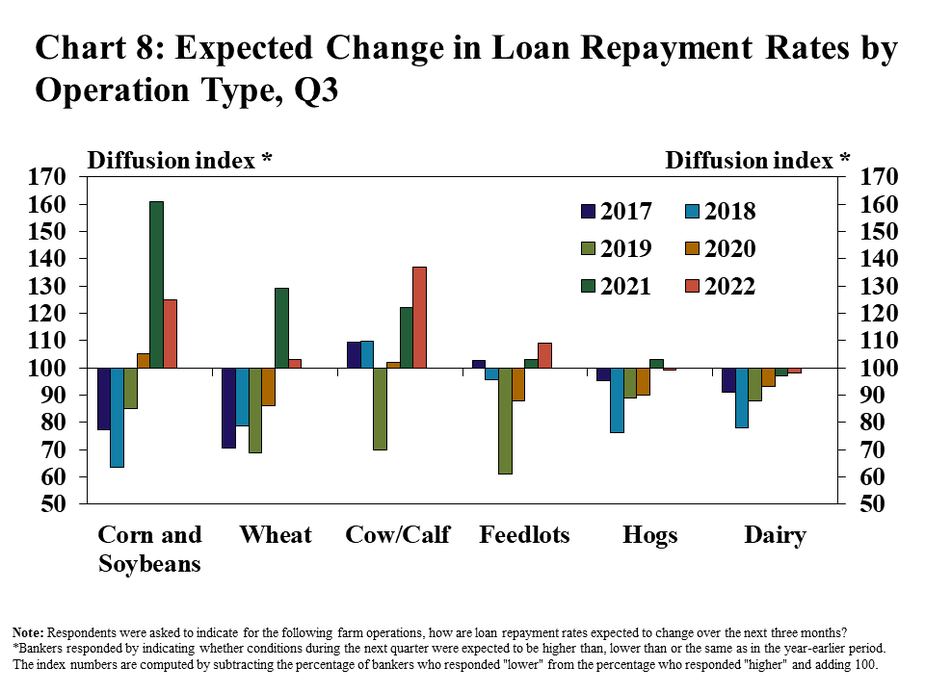

Credit conditions for most types of farm operations were expected to improve slightly or remain steady in the coming months. Farm loan repayment rates for crop farmers were expected to increase further in the next three months, but at a slower pace than last year (Chart 8). Bankers anticipated repayment for borrowers in the cattle industry to improve at a faster rate than last year, while conditions for hog and dairy producers were expected to be mostly steady.

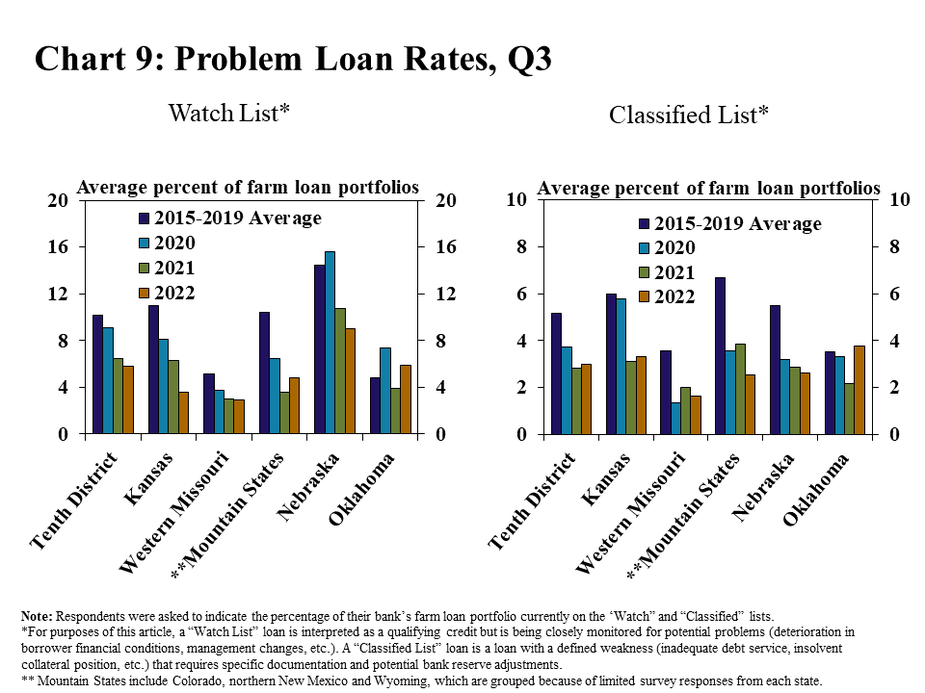

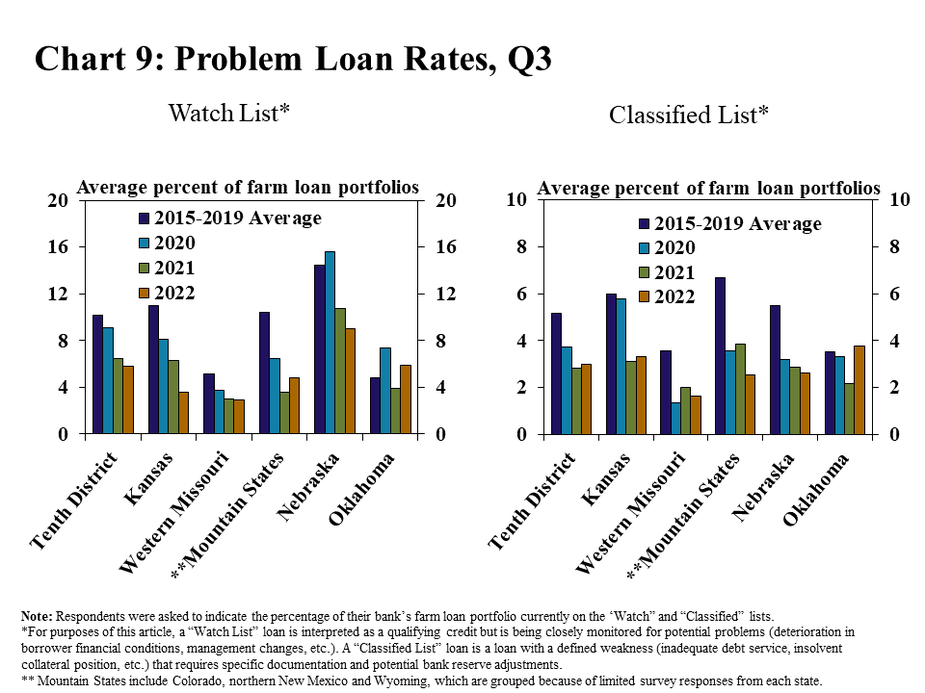

With consistent improvement in repayment, problem loan rates remained low across the District. About 6% and 3% of farm loan volumes through the region were on the watch list or considered classified, respectively, as of the third quarter (Chart 9). The share of portfolios with repayment issues declined slightly or remained the same as a year ago in most states, but increased slightly in Oklahoma, where the farm economy has diverged from surrounding states.

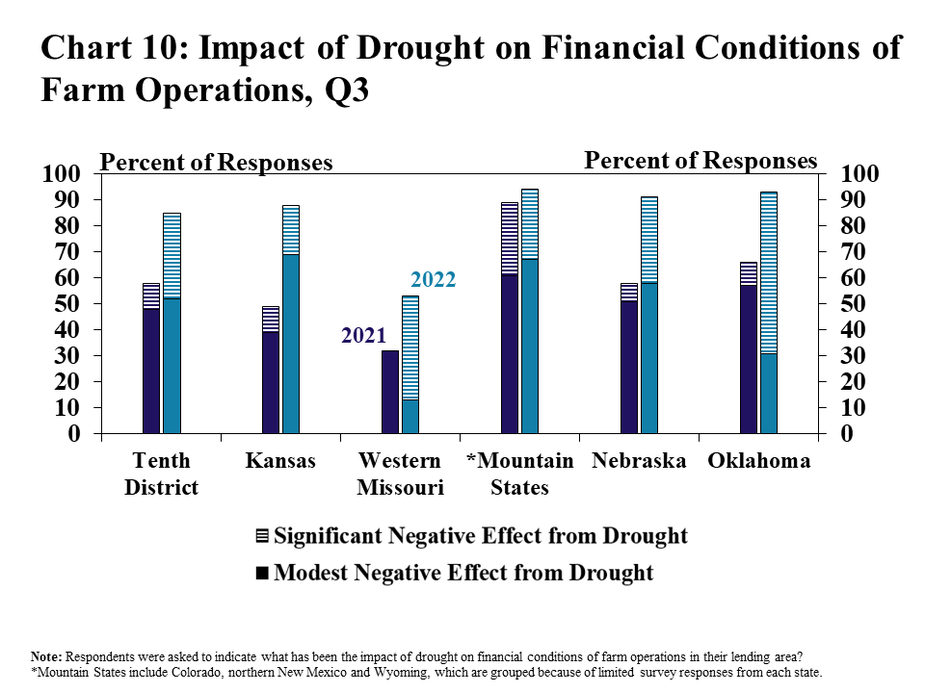

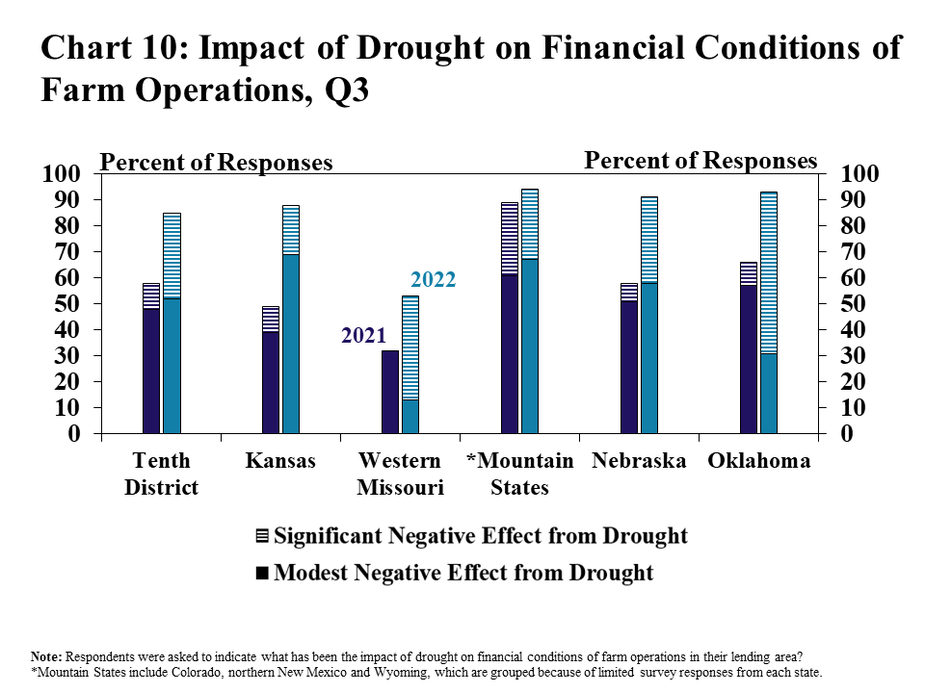

Despite strong conditions in the broad farm economy, persistent drought throughout large portions of the District intensified concerns about financial impacts. As conditions have worsened, the share of banks reporting a modest and significant impact of drought increased from a year ago to about 50% and 35%, respectively (Chart 10). Conditions were comparatively worse in some areas of the District, particularly in Oklahoma, where 60% of bankers reported that the impact of drought was significant.

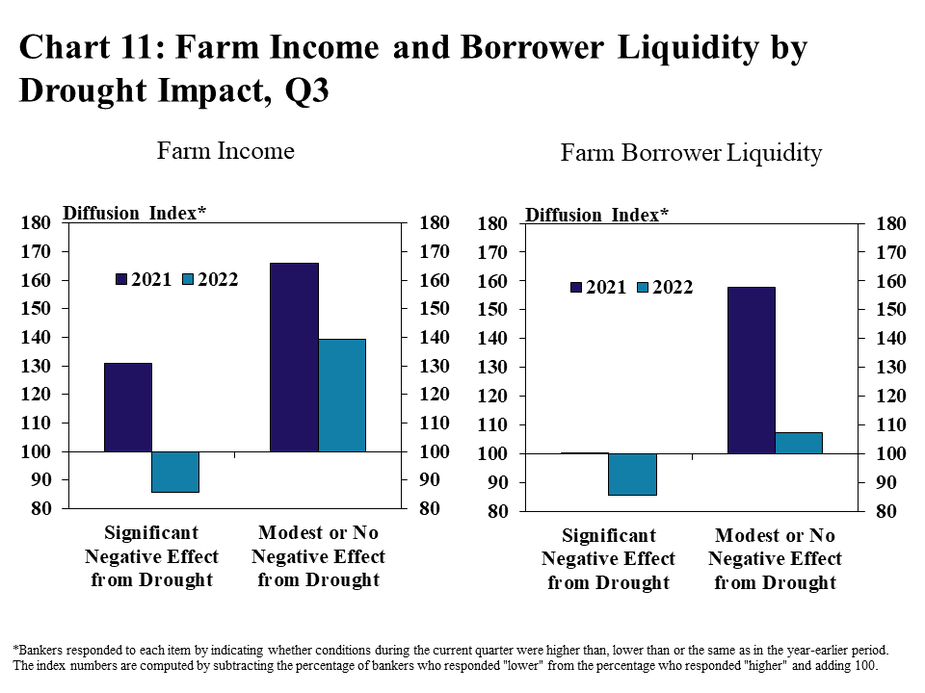

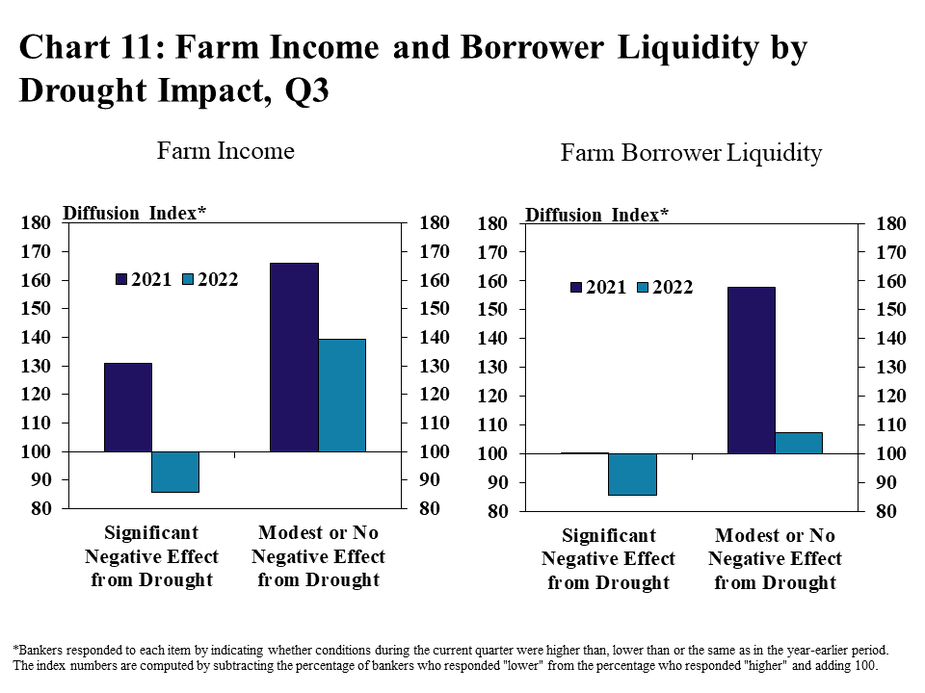

As drought has persisted over the past year, farm finances weakened in areas most impacted. In contrast to the same time a year ago, banks reporting a significant effect of drought also reported that farm income and borrower liquidity was lower than a year ago (Chart 11). Respondents who described the effect as modest continued to report strong conditions, but a slower pace of improvement.

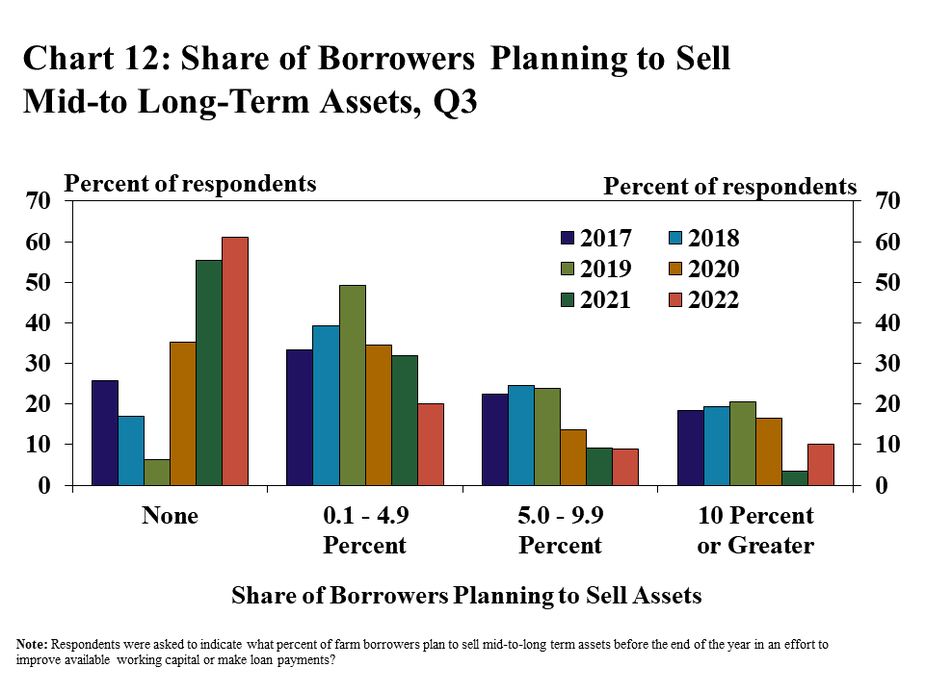

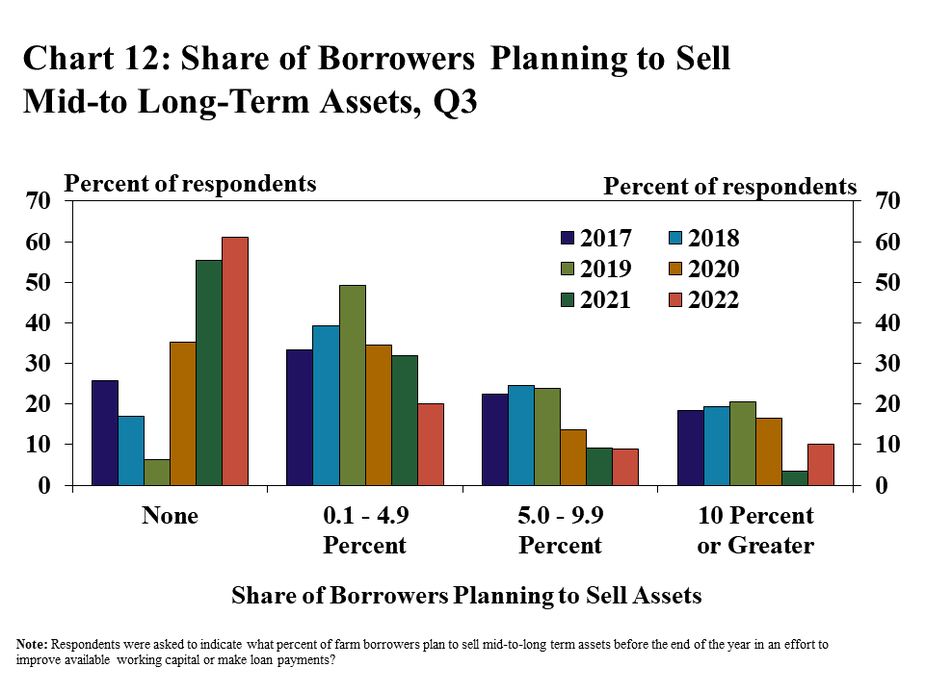

Asset liquidation was notably more prevalent in areas most heavily impacted by drought. The share of banks reporting sales of assets to improve financial positions declined for the third consecutive year, with almost two thirds of respondents reporting no liquidation (Chart 12). However, a slightly larger share of banks reported more than 10 percent of borrowers made sales to help with cash flow and all were located within areas of the District with the most severe drought conditions.

Banker Comments Q3 2022

“Uncertainty seems to be a major attitude right now. Livestock prices remain very good, but inputs such as hay and fertilizer are really high.” – Southeast Kansas

“The drought will significantly reduce yields and income and increasing interest rates will add to the negative impact. But most farmers have equity to help them get through this tough period.”– Central Missouri

“This is going to be a very challenging financial situation for small farmers going into 2023 with inflation, high interest rates, volatile markets, and extremely high input costs. Many of the producers in our area are very concerned.”– Southwest Oklahoma

“Drought has been and will continue to be a huge concern for the 2022 and 2023. Pastures are dry, livestock is coming into the feedlots earlier, it’s creating more feed expense and in some cases liquidation of cow herds.”– Northwest Nebraska

“Increased input costs are concerning and the ability of historically strong prices to maintain profitability is being closely monitored.”– Northeast Kansas

“Weather has been very favorable in our area which has led to what is expected to be an excellent crop year, but input costs remain a drag on the net income outlook moving into 2023.”– Northwest Missouri

“Drought has been a problem in our area, but prices will make up for any short yields and most of our farm customers are still projected to have a good year financially despite drought and inflationary costs.”– Northeast Nebraska

“The ongoing drought in Oklahoma is somewhat of a concern that we will see similar drought conditions to Texas and the overall inflationary impact is affecting living expenses.” Southern Oklahoma

Data: Excel SpreadsheetCredit Conditions | Excel SpreadsheetFixed Interest Rates | Excel SpreadsheetVariable Interest Rates | Excel SpreadsheetLand Values

A total of 110 banks responded to the Third Quarter Survey of Agricultural Credit Conditions in the Tenth Federal Reserve District—an area that includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, the northern half of New Mexico and the western third of Missouri.