Industry losses to force herd contraction in 2H 2023 and 2024

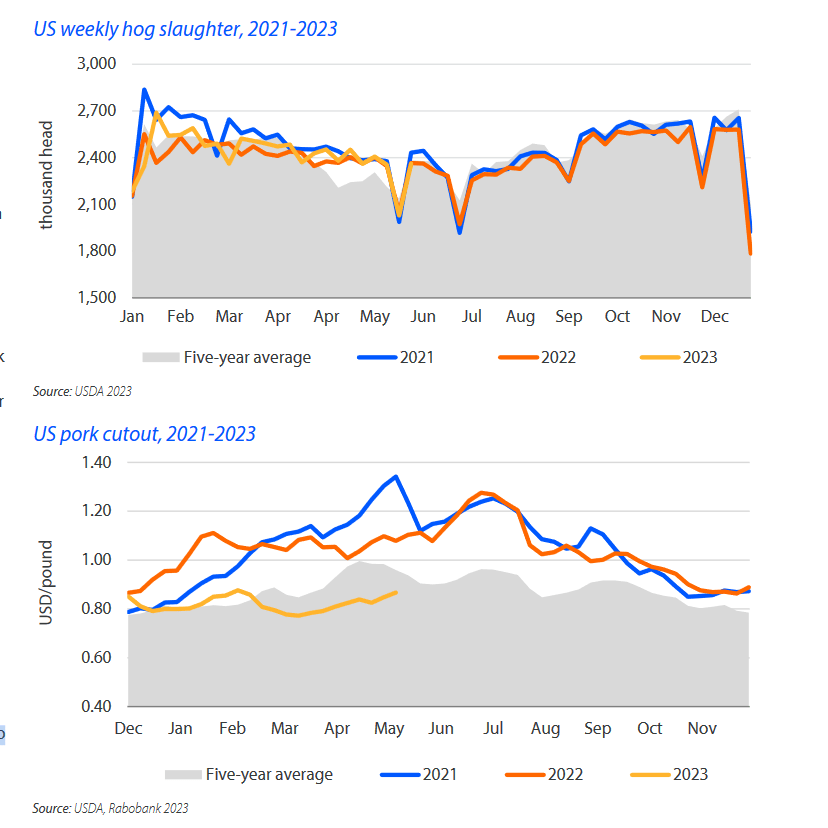

*Hog prices moved higher in recent weeks on seasonally tighter supplies and improved visibility around the integration of Proposition 12 in California. Lower weekly slaughter (-1% YOY) and lighter weights (-1.6% YOY) have reduced production since late May, helping to stabilize prices. While producers continue to struggle during what is traditionally a season of stronger margins, a rebound in prices and a gradual decline in feed costs have improved the near-term outlook. While current sow slaughter remains low, we expect contraction in the sow herd to begin in 2H 2023. Depressed returns also support our outlook for lower farrowing intentions in the upcoming Hogs and Pigs inventory report. Based on our current outlook, we expect at least a 7% decline in the US sow herd over the next 12 to 18 months will be needed in order to restore herd profitability.

*Pork prices remain weak on a slow start to the grilling season. The pork cutout is 20% below year-ago levels, as sharply lower belly prices (-46% YOY) continue to weigh on carcass values. Weaker loins (-17% YOY) and ribs (-36% YOY) failed to offer support, though there has been a modest improvement in ham values from depressed levels earlier this spring. A lack of retail promotions and the resulting high pork prices have slowed consumption this spring. Pork remains a good value for retailers (versus beef), and with improved visibility on the enforcement of Proposition 12, we expect an increase in pork feature activity to drive sales over the summer. Heavy inventories of pork in cold storage in April (+6% YOY) are expected to decline over the summer but could remain a challenge for bellies. Pork prices should continue to see some improvement in 2H 2023 given expectations for lower production and improved consumption and exports.

*April pork and pork variety meat exports were up 10% YOY in volume, to 196,099 metric tons, and up 7% YOY in value. Pork volumes to China/Hong Kong (+26% YOY), South Korea (+43% YOY), and Mexico (+5% YOY) grew, while sales to Japan (-2% YOY) and Colombia (-41% YOY) slipped. Pork imports from all destinations dropped (-33% in volume), given depressed local markets. We are currently forecasting 2023 export growth of 8% YOY given the low relative cost of US pork in global markets.

*Mexican hog prices are gradually moving higher after bottoming in late May. Despite the improvement, hog prices are down 20% YOY and 8% below the five-year average on weak packer demand. Despite some improvement in margins on lower feed costs, the industry is moving to reduce the sow herd to better align production and demand. Pork prices continue to move lower, down 16% versus the Q1 2023 average and 6% below year-ago levels. Weaker domestic and export demand and steady imports (+1.4% YOY) continue to overwhelm the domestic market, pressuring prices. We expect production growth to slow to 2.1% in 2023.