Over the past several years building costs and interest rates have emerged as critical factors for pork producers, shaping decisions around new construction and expansion in the swine industry.

The dual pressures of escalating construction expenses and rising interest rates have placed significant constraints on development.

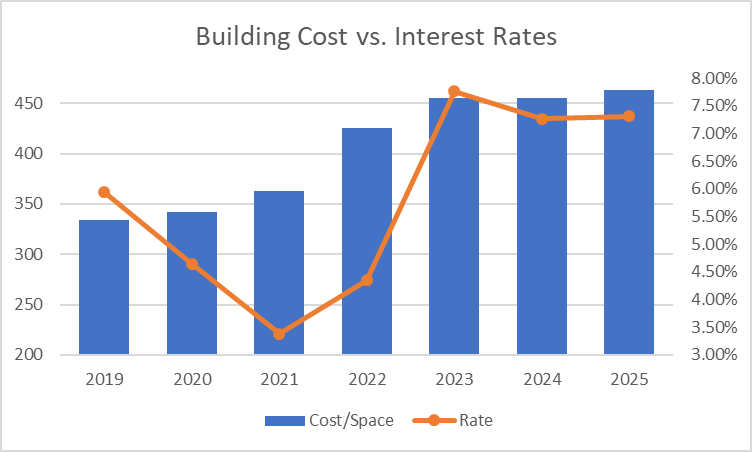

Using long-term trends in building costs and interest rates from 2024 actuals and 2025 projections, we found an upward trajectory in both areas.

The following graphs, focusing on a standard 2,400-head wean-to-finish barn, provide a detailed analysis under the outlined assumptions:

- 15-year term loan

- 85% loan financing

- Solid borrower credit

- Southern Minnesota and Northern Iowa cost averages

- Costs include all aspects except land

- Rates may vary based on specific loan pricing, products, young farmer program qualifications and terms

Interest rates, recorded from early to mid-January each year, reflect conditions for borrowers with above-average credit.

While overall site building costs can vary depending on factors such as equipment packages, material quality and other variables, the trend presented here reflects the broader challenges faced by pork producers across the countryside.

Stable Yet Shifting: The Cost of Building in 2025

There are a few key points to consider when analyzing this data:

1. Material Costs

Since 2019, overall building costs have risen by nearly 40%, with the most significant increases occurring after the onset of the pandemic.

2. Labor Availability

Although costs have stabilized over the past three years, we’ve observed a slight year-over-year uptick. This increase is primarily due to modest rises in lumber prices and higher costs for service-based work such as electrical, plumbing and excavation.

Interest Rates: Holding Steady, but Still High

Wouldn’t it be nice to return to the low interest rates of 2020–2022?

Today, we’re navigating rates in the mid-7% range. Yet, rates have remained relatively stable in recent years, even if they are slightly higher than they were this time last year. The 10-year U.S. Treasury chart illustrates this recent volatility.

As we approached the election, rates had dropped by nearly a full percentage point since mid-year. However, the financial market outlook and changes in the Federal Reserve’s stance have brought rates back above year-ago levels.

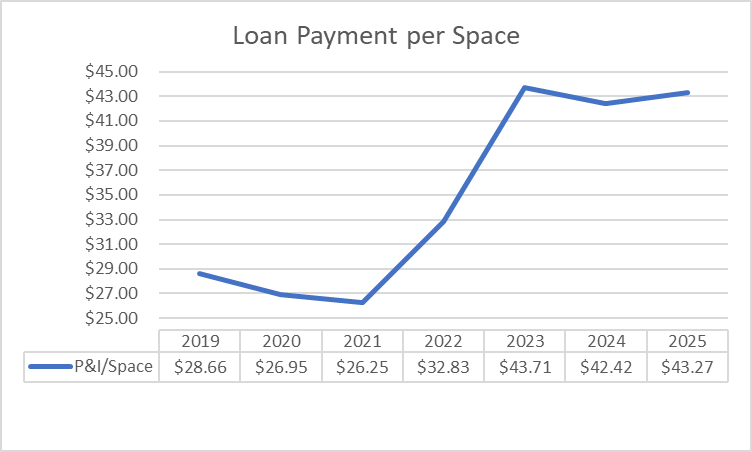

Chart 1 illustrates the loan payment per space based on current interest rates, building costs and the loan terms outlined above. While this figure has increased year-over-year, it remains slightly below the peak reached in 2023.

What Does This Mean for Farmers?

Despite the rising building costs and interest rates, constructing new grow-finish hog barns offers a few key benefits.

Firstly, the manure produced provides significant value for improving cropping operations. Secondly, hog barns have historically served as reliable equity builders.

Additionally, the income generated from these investments can be strategically managed through depreciation.

Compeer Financial: Your Partner in Growth

Navigating the complexities of building costs and interest rates requires a trusted financial partner.

At Compeer Financial, we specialize in helping pork producers secure financing solutions that align with their long-term goals.

Whether you’re planning a major expansion or simply weighing your options, our team of swine industry experts are here to help.