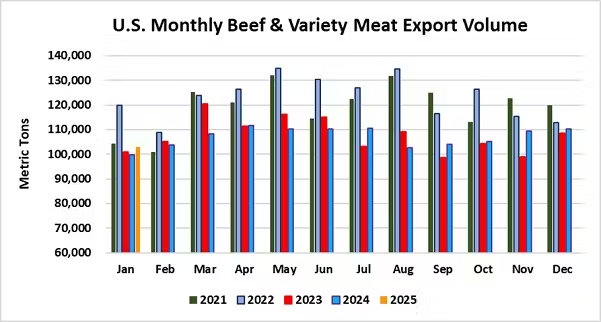

Exports of U.S. beef trended higher than a year ago in January, according to data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Pork exports were slightly below last January’s large totals, despite another outstanding performance in Mexico and Central America.

January beef exports reached 102,840 metric tons (mt), up 3% year-over-year, while value increased 5% to $804.6 million. Growth was driven in part by larger exports to China and Canada, while exports to South Korea were steady in volume but higher in value. Strong value increases were also achieved in other key markets, including Taiwan, the Caribbean, Central America and the ASEAN. Exports of beef variety meat were the largest in nearly two years, led by larger shipments to Mexico, Egypt, Canada and China/Hong Kong.

“Demand for U.S. beef came on strong in the Asian markets late last year, and that momentum largely continued in January,” said USMEF President and CEO Dan Halstrom. “The performance in Korea is especially encouraging, given the country’s political turmoil and slumping currency. It is also gratifying to see exports trending higher to China, though we are concerned about access to the market moving forward, as many U.S. beef and pork plants are awaiting word on their eligibility beyond mid-March.”

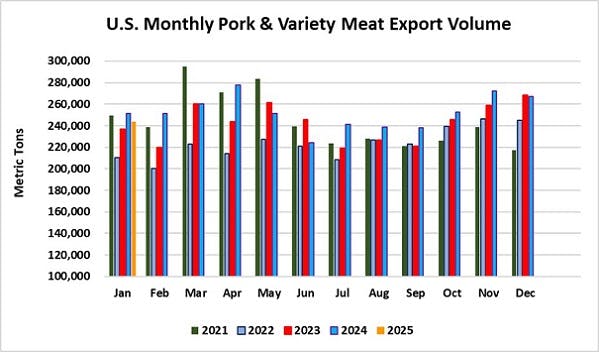

Pork exports totaled 243,965 mt in January, down 3% from a year ago, while value eased 2% to $668 million. Shipments soared to Central America and continued to trend higher to leading market Mexico. Exports also increased year-over-year to China/Hong Kong, the Philippines, Australia and New Zealand, but these results were offset by sharply lower shipments to Japan, Korea and Colombia.

“U.S. pork is coming off a record-breaking year in 2024 and we see opportunities for continued growth this year,” Halstrom said. “Our Western Hemisphere markets are obviously critical to this success, so the White House pausing tariffs on some goods imported from Mexico and Canada is certainly encouraging news. Duty-free access to Mexico, Canada and other free trade agreement partners has definitely underpinned global demand for U.S. red meat and delivered essential returns at every step of the supply chain. The majority of U.S. red meat exports are to countries with which we have trade agreements. Maintaining trust and access to these markets is critical to the continued success of the U.S. industry.”

Demand for U.S. beef remains resilient in key markets

January beef exports to leading value market Korea were steady with last year at 18,801 mt, while value climbed 7% to $182.4 million. Although January shipments were below the levels achieved in the fourth quarter of 2024, Korea’s demand for U.S. beef has held up well despite ongoing economic uncertainty stemming from the impeachment of embattled President Yoon Suk Yeol, with the Korean won recently trading at its lowest levels versus the U.S. dollar since 2009.

Beef exports to China totaled 15,920 mt in January, up 35% from the low volume posted a year ago, while value climbed 34% to $137.3 million. Similar to Korea, China’s demand for U.S. beef rebounded significantly in the second half of 2024. However, the U.S. industry faces great uncertainly in China as the registrations for most exporting establishments are set to expire March 16. U.S. officials are working to resolve the issue but if these plants are no longer eligible after mid-March, this will largely unravel the market access gains achieved under the U.S.-China Phase One Economic and Trade Agreement, and the billions of dollars in trade this agreement unlocked for the U.S. industry. U.S. beef will soon be subject to an additional 10% tariff in China, bringing the total to 22% effective March 10. Exports to Hong Kong (which totaled 2,838 mt in January, valued at $25.7 million) are not impacted by the plant eligibility situation and are not subject to the retaliatory tariffs.

Beef exports to the Middle East rebounded impressively in 2024 and continued to trend higher in January. Exports totaled 5,120 mt, up 5% from a year ago, while value increased 13% to $21.5 million. This was driven primarily by robust beef variety meat shipments to Egypt, which were the highest since December 2022 and climbed 10% in volume (3,994 mt) and 25% in value ($6.9 million). Although beef muscle cut exports to the United Arab Emirates (UAE) were below last year in volume (308 mt, down 34%), value climbed 18% to $5.9 million. Shipments to the UAE had slowed sharply toward the end of 2024 due to issues related to halal certification.

Other January results for U.S. beef exports include:

- Beef exports to Mexico were down slightly from a year ago, declining 2% in both volume (19,724 mt) and value ($110.1 million). Beef variety meat exports were a bright spot, however, as volume reached the highest level since 2016, climbing 16% to 11,871 mt, valued at $31.3 million (up 15%). Mexico is the top export destination for U.S. exports of beef tripe, intestines, hearts and lips. In January, exports of U.S. beef tripe to Mexico accounted for $8.14 per every head of fed cattle harvested, lips were $3.84, hearts were $2.34 and intestines were $0.49.

- January exports to Canada climbed 20% from a year ago to 8,457 mt, while value increased 2% to $65.9 million. The modest increase in value was mainly due to variety meat making up a larger share of the product mix, as variety meat exports jumped 154% to 1,300 mt, the highest since 2012.

- Exports to the Caribbean, which were record-large in 2024, continued to expand in January as shipments increased 3% to 2,757 mt, valued at $24.6 million (up 18%). Growth was driven mainly by strong demand in the Dominican Republic, the Bahamas the Netherlands Antilles and Turks and Caicos.

- Central America also took record shipments of U.S. beef last year. Although January exports to the region were down slightly in volume (1,931 mt, down 1%), export value soared 24% to $15.7 million. Exports to Costa Rica climbed 92% to 556 mt, with value more than doubling to $4.5 million (up 125%). Robust growth was also achieved in Honduras. Exports to top market Guatemala were 5% below last year’s high level but remained strong at 850 mt, and export value increased 13% to $7.35 million.

- January exports to South America dipped 7% from a year ago to 1,371 mt, but value still climbed 13% to just under $10 million. Shipments to Chile were up 41% (to 380 mt) from last year’s low volume and jumped 53% in value to $3.6 million. Although exports to Colombia remained below last year at 339 mt (down 30%), export value reached $3.2 million – up 12% from a year ago and the highest since February 2024. Exports to Colombia slowed last year due to H5N1-related restrictions, but have been gradually rebounding since full access was restored in late September.

- Beef exports to Taiwan totaled 3,140 mt, down 2% from a year ago, but value increased 7% to $38.5 million. Shipments to Taiwan gained momentum in the second half of 2024, reaching the second highest value on record at $709.2 million. Taiwan has one of the highest unit export values for U.S. beef and in January, the U.S. captured 73% of Taiwan’s imported chilled beef market.

- Japan’s demand for U.S. beef took a step back in January, declining 10% from a year ago to 19,076 mt, while value dropped 9% to $139.5 million. Variety meat exports – mainly tongues and skirts – fell 12% in volume (3,265 mt) and 24% in value ($29.6 million).

- Despite the decline to Japan, January exports of beef variety meat reached 25,838 mt – up 11% from a year ago and the highest since May 2023. Value fell 3% to $86.4 million, reflecting the fact that tongues to Japan are the highest-value item in this category. In addition to the aforementioned growth in Egypt, Mexico and Canada, variety meat shipments also increased to China/Hong Kong, Chile, Trinidad and Tobago, the Bahamas, Costa Rica and Panama.

- January beef exports equated to $371.37 per head of fed slaughter, up 3% from a year ago. Exports accounted for 12.7% of total beef production and 10.2% for muscle cuts only, each down slightly from a year ago.

Mexico and Central America shine again for pork exports, but shipments decline to Japan, Korea

Coming off a monster year in which shipments topped $2.5 billion in value for the first time, pork exports to Mexico continued to climb in January. Exports increased 2% from a year ago to 104,502 mt, the fourth highest on record, while value jumped 7% to $222 million. Mexico accounts for about half of U.S. ham production and more than 10% of total U.S. pork production, and it is the second largest destination for U.S. pork variety meat, trailing only China.

U.S. pork’s presence in Mexico continues to expand even as it faces heightened competition from Brazil. Capitalizing on temporary duty-free access, the Brazilian industry shipped about 43,000 mt of pork to Mexico in 2024, capturing 3% market share. Mexico’s pork imports from Canada, Chile and Europe also currently enter at zero duty.

Pork exports to Central America were also record-large in 2024 and did not miss a beat in January. Fueled by robust growth in top markets Honduras and Guatemala and sharply higher shipments to Costa Rica and Nicaragua, exports to the region soared 22% from a year ago in volume (14,510 mt) and 30% in value ($46.5 million). Consumer education programs and seminars, most of which focus on the loin, have helped position U.S. pork as a versatile, center-of-the-plate protein enjoyed by a rapidly growing number of Central American households.

Also on the heels of a record year, pork exports to New Zealand raced to a rapid start with January exports jumping 71% from a year ago to 1,063 mt, valued at just under $4 million (up 67%). With exports also increasing modestly to Australia, January exports to Oceania were up 7% in volume (10,369 mt) and 4% in value ($36.8 million).

Other January results for U.S. pork exports include:

- Although well below the volumes seen earlier this decade, pork exports to China/Hong Kong gained momentum in the second half of 2024 and continued to trend higher in January. Exports climbed 6% from a year ago to 37,596 mt, while value increased 9% to $92.3 million. This included more than 14,000 mt of muscle cuts, up 59% from a year ago, valued at $33.8 million (up 61%). Similar to beef, pork exporters serving China face uncertainty about their eligibility after mid-March. China is the largest destination for U.S. pork variety meat, taking 322,000 mt last year, and no alternative market can approach this volume at the price Chinese buyers pay. U.S. pork will also face heightened retaliatory duties effective March 10, when China’s effective tariff rate will increase from 37% to 47% (a combination of the 12% most favored nation rate + a 25% Section 232 metal tariff retaliation from 2018 + a new 10% duty).

- January pork exports to the Philippines remained higher year-over-year as shipments were up 3% to 3,145 mt and value increased impressively – climbing 31% to $6.9 million. The Philippine Department of Agriculture recently announced plans to allocate more in-quota imports (tariffed at 15% versus 25% out-of-quota) to meat processors, which could result in more in-quota treatment for U.S. pork.

- After a fairly steady year in 2024, pork exports to Japan slowed in January to 22,272 mt, down 21% from a year ago, while value also fell 21% to $90.8 million. Frozen pork has accounted for a larger share of U.S. exports to Japan, due in part to the persistently weak yen. The yen has rallied modestly in March, mainly on speculation that the Bank of Japan is ready to raise interest rates.

- Pork exports to Korea saw significant growth in 2024, achieving an annual value record of $728 million. But exports slowed in the fourth quarter, and this trend continued in January as shipments fell 21% to 16,453 mt, valued at $52.7 million (down 22%). U.S. pork enters Korea at zero duty, but the market is highly competitive as several other suppliers also have trade agreements that include duty-free access.

- Pork exports to the Caribbean were record-large in 2024 but took a step back in January, falling 11% in volume (8,706 mt) and 2% in value ($27.6 million). But Cuba continued to be bright spot, with shipments climbing 65% to 925 mt and value more than doubling to $3.3 million (up 107%).

- Colombia’s soaring demand for U.S. pork also slowed in January, as exports declined 19% from a year ago to 8,491 mt, valued at $28.1 million (down 12%). Colombia posted a record performance in 2024, with pork export value jumping 32% to $360 million.

- January pork exports equated to $58.26 per head slaughtered, down 3% from a year ago. Exports accounted for 27.1% of total pork production and 23.8% for muscle cuts only, down from the year-ago ratios of 28.3% and 24.3%, respectively.

Lamb exports fairly steady, with growth continuing in Mexico and Caribbean

January exports of U.S. lamb fell 7% from a year ago to 282 mt, while value was down 1% to $1.68 million. But muscle cut exports increased slightly in both volume (255 mt) and value ($1.46 million), led by robust growth in Mexico, Trinidad and Tobago and the Netherlands Antilles. These gains were partially offset by sharply lower shipments to Canada.

omplete January export results for U.S. pork, beef and lamb are available from USMEF’s statistics web page.

For questions, please contact Joe Schuele or call 303-547-0030.

NOTES:

- Export statistics refer to both muscle cuts and variety meat, unless otherwise noted.

- One metric ton (mt) = 2,204.622 pounds.

- U.S. pork and beef currently face retaliatory duties in China. In February 2020, China announced a duty exclusion process that allows importers to apply for relief from duties imposed in response to U.S. Section 301 duties. When an application is successful, the rate for U.S. beef can decline to the MFN rate of 12% and the rate for U.S. pork can decline to 37% (the MFN rate plus the 25% Section 232 retaliatory duty, which remains in place). China is set to impose an additional 10% retaliatory duty on U.S. pork and beef on March 10, 2025.