The imposition of tariffs could affect international demand for pork variety meat products.

The U.S. pork industry prides itself on marketing “everything but the oink,” meaning virtually no part of a market hog goes to waste. Products range from sizzling bacon to pharmaceutical drugs and industrial chemicals. Thus, U.S. pork producers can rest assured, knowing the product of their toil is providing not only nourishment but also lifesaving essentials for people in the United States and around the globe.

Export markets are an increasingly important outlet for U.S. pork products. The USDA estimates approximately 26% of total U.S. pork production was exported in 2024. Top pork export destinations include Mexico, China, Japan, South Korea and Canada. Recent trade uncertainty has proven worrisome for industries, including pork, that rely heavily on export markets. Possible tariffs on Canada, China and Mexico were announced in early February 2025. These measures would potentially impose 25% tariffs for goods from Mexico and Canada that comply with the United States-Mexico-Canada Agreement (USMCA), affecting approximately 50% of Mexican imports and 38% of Canadian imports. Many of the goods covered by the USMCA are agricultural and food products, with some exceptions. The fluidity of the situation introduces another level of uncertainty regarding how our trading partners will respond and which products will be affected by any retaliatory measures. The U.S. has imposed tariffs on Chinese goods, and in return, China has imposed 10% tariffs on many U.S. agricultural products, including pork.

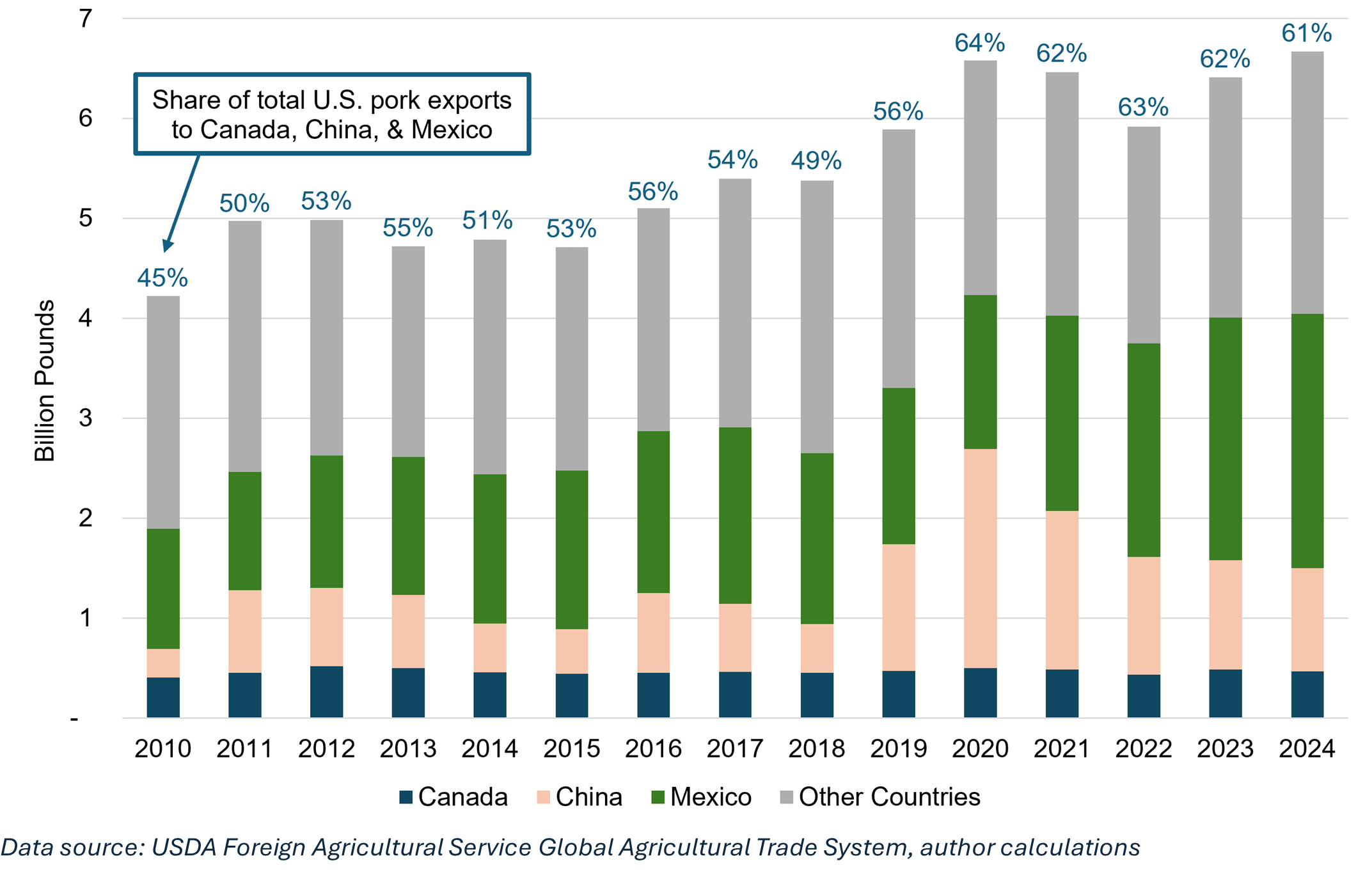

The current trade landscape creates ample uncertainty for the U.S. pork industry. Figure 1 showcases total U.S. pork exports since 2010. The total volume exported is increasing; the share of exports flowing to Canada, China and Mexico are likewise on the rise. In fact, the share that these three countries comprise of total U.S. pork exports increased from 45% in 2010 to 61% in 2024. Consequently, volatility in trade relationships with Canada, China and Mexico could be detrimental to the domestic pork industry.

Figure 1. Volume of Total U.S. Pork Exports, 2010-2024

Role of Variety Meats in U.S. Pork Exports

Pork is a broad category that encompasses a suite of products, and “everything but the oink” means there is likely a market, somewhere, for a product like pig feet. While perhaps not palatable for the average American consumer, tastes around the world vary. Namely, Asian countries like China are a major outlet for variety meats (offal) that have meager demand in the United States. The variety meats category includes everything from pork tongues to intestines. In 2024, 20% of total U.S. pork exports were in the form of variety meats. That is, roughly 1.3 billion pounds of pork variety meats were exported last year, generating over $1.29 billion in revenue.

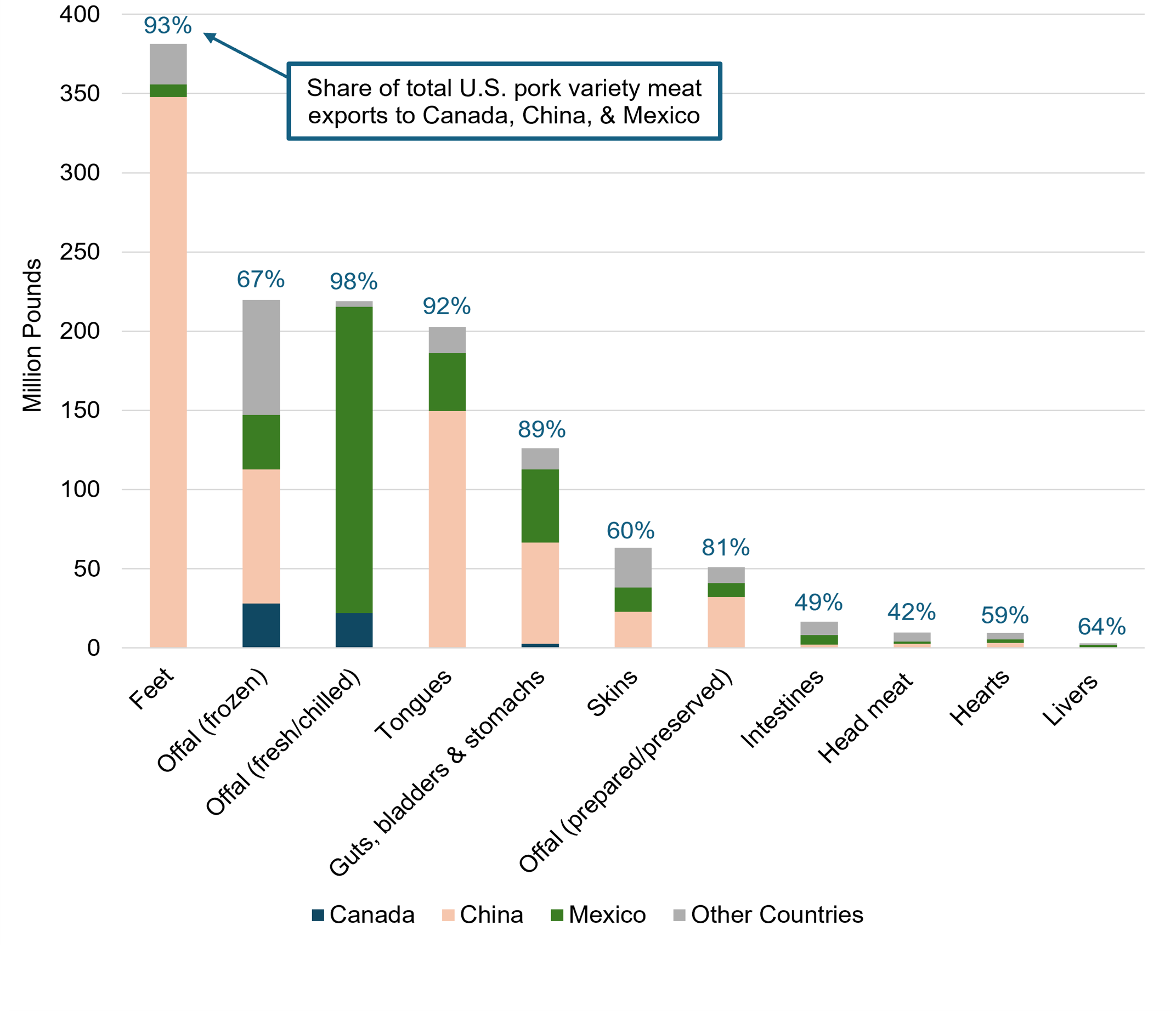

In Table 1, the total volume of exported pork variety meats is broken down into product shares. Nearly 30% of U.S. pork variety meat exports in 2024 were in the form of pig feet, followed by two general offal categories and tongues.

Table 1. Product Shares of U.S. Pork Variety Meat Exports in 2024

| Pork Variety Meat Product | Share of Pork Variety Meat Exports |

| 1. Feet, frozen | 29.3% |

| 2. Offal, except livers, frozen | 16.9% |

| 3. Offal, fresh or chilled | 16.8% |

| 4. Tongues, frozen | 15.6% |

| 5. Guts, bladders & stomachs, whole & pieces thereof | 9.7% |

| 6. Skins, frozen | 4.9% |

| 7. Offal, except liver, prepared or preserved | 3.9% |

| 8. Intestines, frozen, not for use as sausage casings | 1.3% |

| 9. Head meat, frozen | 0.7% |

| 10. Hearts, frozen | 0.7% |

| 11. Livers, frozen | 0.2% |

| Note: Product descriptions are associated with Harmonized System (HS) trade codes | |

Where did these pork variety meat products end up? Largely, in the countries the U.S. is currently targeting with tariff measures. Canada, China and Mexico accounted for the majority of the export volumes for nearly every pork variety meat product, as evidenced in Figure 2. Most notably, nearly all pig feet exports went to China, which, again, was the largest pork variety meat product export category in 2024. Mexico was the purchaser of a vast majority of the fresh/chilled offal product. A combination of China and Mexico accounted for nearly all the exports of tongues, guts, bladders and stomachs.

Trade disruptions with Canada, China and Mexico could have notable repercussions on the U.S. pork market. If these countries seek to procure pork elsewhere as the result of tariffs on U.S. products, market instability for U.S. pork producers could ensue. Furthermore, these countries provide an outlet for pork variety meats that are undesirable to many U.S. consumers. Importantly, exporting these products generates additional value for the U.S. pork industry, as pork variety meats may be disposed of if not otherwise purchased by international consumers.

What ultimately comes of the dynamic trade situation is unknown. Yet, understanding historical trade flows at the product level sheds light on potential implications to consider. Will the U.S. pork industry’s “everything but the oink” utilization approach be able to remain steadfast in the face of looming trade unpredictability?

Acknowledgement: David Ortega of the Department of Agricultural, Food, and Resource Economics at Michigan State University contributed to the content of this article.