Earlier this week, Reuters writer Dominique Patton reported that, “A surge in African swine fever infections in China is set to reduce hog output later this year, farm managers and analysts said this week, pushing up prices in the world’s top pork consumer as demand recovers.

“The incurable disease has plagued China for years, with an initial wave during 2018 and 2019 killing millions of pigs and leading to a dramatic decline in meat output that roiled global markets.”

Patton noted that, “Infections this year began to surge relatively late in the season, around the Lunar New Year holiday in January, when millions of people travelled after China had relaxed its COVID curbs, said three managers at pig farming companies and analysts.

“‘Data from swine fever virus testing companies show that the number of positive detections exploded after the new year holiday. The order of magnitude in a single month has reached the level of the whole year of 2022,’ said analysts at Huachuang Securities in a report on Monday.

“‘We guess that the current swine fever infection area in northern production areas may be reaching 50%,’ it added.”

The Reuters article indicated that, “The disease outbreaks, as well as the prior herd reductions, will lead to fewer hogs reaching the market when demand improves in the second half of the year, said the Huachuang report.”

Also this week, Bloomberg writer Hallie Gu reported that, “China is battling a resurgence of African swine fever, the deadly disease that’s previously wiped out almost half of its hogs, potentially pushing up prices for the country’s most popular meat.”

The Bloomberg article pointed out that, “The outbreak was pretty severe in January and February, especially in the northern producing regions, and some areas are still battling the disease, said Pan Chenjun, a senior analyst at Rabobank. She estimates that the latest wave has affected 10% of the nationwide sow herd, which controls hog production, leading to higher prices in the coming months.”

“The impact of the latest outbreak will take a while to filter through to the market. For now, hog prices are weak on speculation that farmers are rushing their hogs for slaughter due to worries over the disease’s spread. Meanwhile, piglet prices have jumped about 20% so far this year as supplies tighten,” the article said.

Meanwhile, Reuters writer Tom Polansek reported yesterday that, “Chicago Mercantile Exchange lean hog futures sank by the maximum daily trading limit on Thursday on rumors about a potential outbreak of a fatal pig disease which the U.S. government later said were untrue.

Unsubstantiated chatter about a U.S. case of African swine fever swirled in the market, but the U.S. Department of Agriculture told Reuters it was a rumor and the agency had not heard anything about even a suspected case.

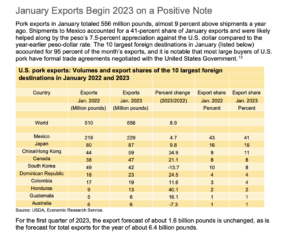

In its monthly Livestock, Dairy, and Poultry Outlook report earlier this week, the USDA’s Economic Research Service (ERS) indicated that, “January 2023 pork exports were 556 million pounds, about 9 percent greater than those of a year ago.

“Exports for 2023 are forecast at almost 6.4 billion pounds, about the same as in 2022.”