Bloomberg writer Hallie Gu reported yesterday that, “Chinese pork prices are likely to stay low for longer, extending a run of miserable profits for pig farmers and complicating efforts to stave off deflationary pressures in the economy.

“An ample supply of hogs and sluggish consumption due to a slowing economy look set to keep the market under pressure, despite the advent of peak demand season over winter. Prices may not recover until the second half of next year.

That’s bad news for agricultural markets, particularly for the meat exporters around the world that supplement Chinese output, and the farmers in the Americas that grow the soybeans and corn to feed China’s vast pig herd.

“It’s also a worry for wider financial markets given pork’s weighting in the basket of goods that measures inflation in Asia’s largest economy.”

The Bloomberg article added that, “The number of sows for breeding, an important determinant of future supply, was 42.4 million at the end of September, according to the farm ministry. That’s 1.3% lower than the previous month but still above the 41 million that the ministry regards as an optimum herd size.”

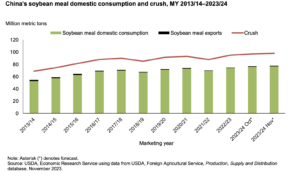

Meanwhile, in its monthly Oil Crops Outlook report this week, the USDA’s Economic Research Service (ERS) indicated that, “China’s soybean crush for MY 2022/23 and MY 2023/24 are each raised this month by 1.0 million metric tons to 95.0 million metric tons and 98.0 million metric tons, respectively.

China’s soybean imports for MY 2023/24 are unchanged and stand at 100.0 million metric tons.

“Notably, soybean imports for MY 2021/22 and 2022/23 are updated this month with the revisions made by China Customs Statistics. According to China Customs Statistics, soybean imports for MY 2021/22 totaled 90.5 million metric tons, 1.1 million metric tons lower than the previous estimate. Soybean imports for MY 2022/23 totaled 100.8 million metric tons, 1.2 million metric tons less than last month’s forecast. As a result of lower soybean imports for 2 consecutive years and higher soybean crush for MY 2022/23 and MY 2023/24, China’s soybean ending stocks are forecast at 33.7 million metric tons, 3.5 million metric tons lower than last month.”

ERS explained that, “With higher soybean crush for both MY 2022/23 and 2023/24, China’s soybean meal production is increased this month to 75.2 million metric tons and 77.6 million metric tons, respectively. The additional soybean meal supply is consumed domestically. Domestic soybean meal consumption for MY 2022/23 totals nearly 74.0 million metric tons, up 1.0 million metric tons from last month’s forecast on higher crush and lower soybean meal exports. The domestic soybean meal demand for MY 2022/23 grew by 6 percent on a modest recovery in the livestock sector. China’s domestic soybean meal consumption for 2023/24 is forecast to increase by 4 percent to reach 76.8 million metric tons.”

In other news regarding China trade, ERS pointed out this week in its monthly Feed Outlook report that, “Many factors impact global sorghum trade flows, resulting in volume variability. For the United States, however, robust sorghum exports are heavily dependent on China’s sorghum purchasing. Over the last 3 marketing years, China has accounted for 86 percent of U.S. sorghum exports, on average.”

ERS added that, “To start 2023/24, U.S. sorghum export shipments topped 12 million bushels. Notably, close to 97 percent of U.S. September 2023 sorghum exports were destined for China. Moreover, total U.S. sorghum export commitments eclipsed 120 million bushels as of November 2, 2023, with more than 80 percent reported for China.”

Elsewhere, Yasmeen Abutaleb and John Hudson reported on the front page of today’s Washington Post that, “President Biden and Chinese leader Xi Jinping agreed on Wednesday to restore communications between their countries’ militaries after they met face-to-face for the first time in a year, lowering tensions between the two superpowers at a time when the White House is struggling to manage wars in Europe and the Middle East.”

Also in today’s Post, Danielle Paquette reported that, “Given the fraught U.S.-China relations, one of the few groups openly pleased to see Xi during his first stateside visit in six years is a mix of Iowans whom the leader has called his ‘old friends.’ Some hosted him nearly four decades ago, when Xi was a junior official from Hebei province on a tour of America’s heartland, offering him plates of scrambled eggs and bacon as well as a spare bedroom adorned with Star Wars figurines. Others met him years later when, as a rising political star, he returned to the same rural scene.”

Paquette noted that, “This week’s dinner invitation to [Iowa soybean farmer Rick Kimberley] and other Iowans whom Xi befriended decades ago signals a shift from his more confrontational posturing, said Jonathan Hassid, a political science professor at Iowa State University who focuses on Chinese influence.”

And Reuters News reported today that, “Chicago soybean futures retreated on Thursday from a 2-1/2 month high reached in the previous session as an improving weather outlook in major South American exporters like Brazil eased supply concerns.”

“Soybeans have rallied 11% from a mid-October low as hot, dry weather in key cropping areas of Brazil, the world’s biggest soybean exporter, disrupted planting, but rain is forecast in those regions next week and global supply remains plentiful,” the Reuters article said.