Improved Wholesale Pork Prices Widen Packer Spread in July

July was another month in 2023 when most pork producers would have been fortunate to break even. Federally inspected (FI) July hog slaughter, estimated at about 9.6 million head, was 3.2 percent higher than a year ago. Estimated FI pork production, at roughly 2 million pounds, was about 2 percent higher than in July 2022 due to lighter July 2023 average dressed weights. Seasonal heat and high feed costs contributed to weights averaging about 2.5 pounds below those of last July. While feed costs have moderated compared to earlier this year, they are still high relative to hog prices. Lighter dressed weights might also explain the relation of July slaughter to the 180-pound-and-over category of the June Hogs and Pigs report. The number of hogs that were slaughtered during the period when these animals achieved slaughter weight— which encompassed most of July—was slightly higher than the number implied in the June report. This suggests that some animals may have been pulled forward; that is, the slaughter of lighter weight animals lowered the already-lower July dressed-weight average even more. July prices of live equivalent 51-52 percent lean hogs averaged $73.92 per hundredweight (cwt), 12 percent lower than a year ago.

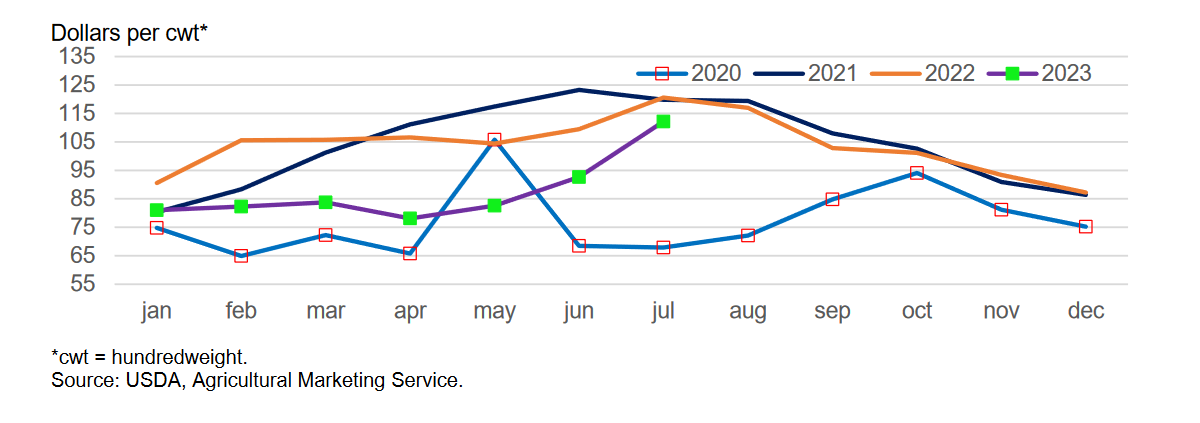

Wholesale pork carcass values averaged $112.17 per cwt in July, scoring another high for 2023 and continuing a summer surge that began in June. The figure below is notable because while the July cutout was almost 7 percent below that of July 2022, both June and July cutout values show departures from the sluggish pace that marked the first 5 months of 2023. Higher pork cutout values are likely driven by a seasonal component—vacationing consumers patronizing quick-service restaurants while traveling, combined with outdoor grilling of ribs, smoking picnics, loins, etc.—at the same time that high prices of substitute proteins (beef cuts in particular) are likely inclining consumers to substitute pork cuts.

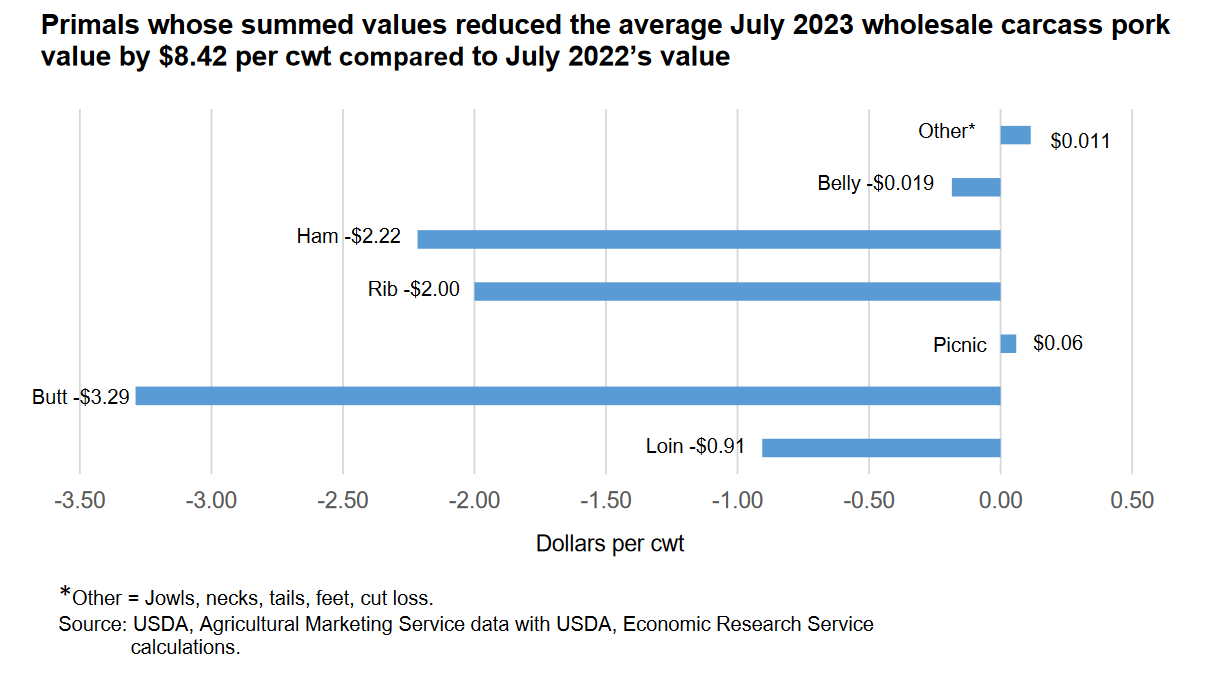

The $8.42 per cwt difference between the cutout of this year (July 2023) and July 2022 is

disaggregated according to proportion, or share, of the carcass that each primal comprises in the figure below. The bars in the figure indicate that declines in the values of butt, ham, and rib 18 primals accounted for 89 percent of the $8.42 per cwt year-over-year decline in the July 2023 cutout value.

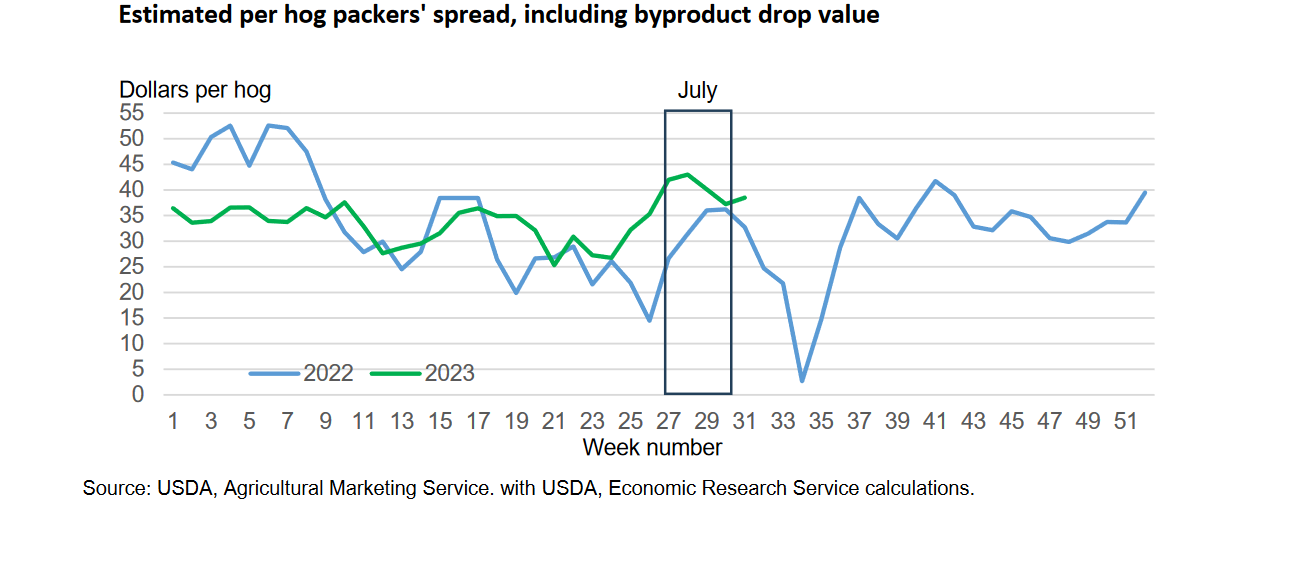

Increasing wholesale pork prices, compared with other relatively more expensive substitute

meats, seemed to have hit a seasonal sweet spot with consumers beginning in June and

continuing through July. This factor combined with lower–than–year–earlier July hog prices

resulted in higher per hog packer spreads relative to last year, even in an economic environment favoring lighter dressed weights. The July packer spread averaged almost $41 per head, 25 percent more than a year ago.

percent lower than production in the same period a year ago. The change was made on

expectations of continued-lower average dressed weights. Prices of live equivalent 51-52

percent lean hogs are expected to average $74 per cwt in the third quarter, almost 8 percent below prices in the third quarter of 2022. Hog prices for the fourth quarter of 2023 were raised to $63 per cwt, about 1 percent lower than in the same period of 2022. Total 2023 commercial pork production is expected to be 27.3 billion pounds, 1 percent higher than 2022 production. Forecast quarterly hog prices average to $62.13 per cwt for 2023, about 12.7 percent below average quarterly prices in 2022.

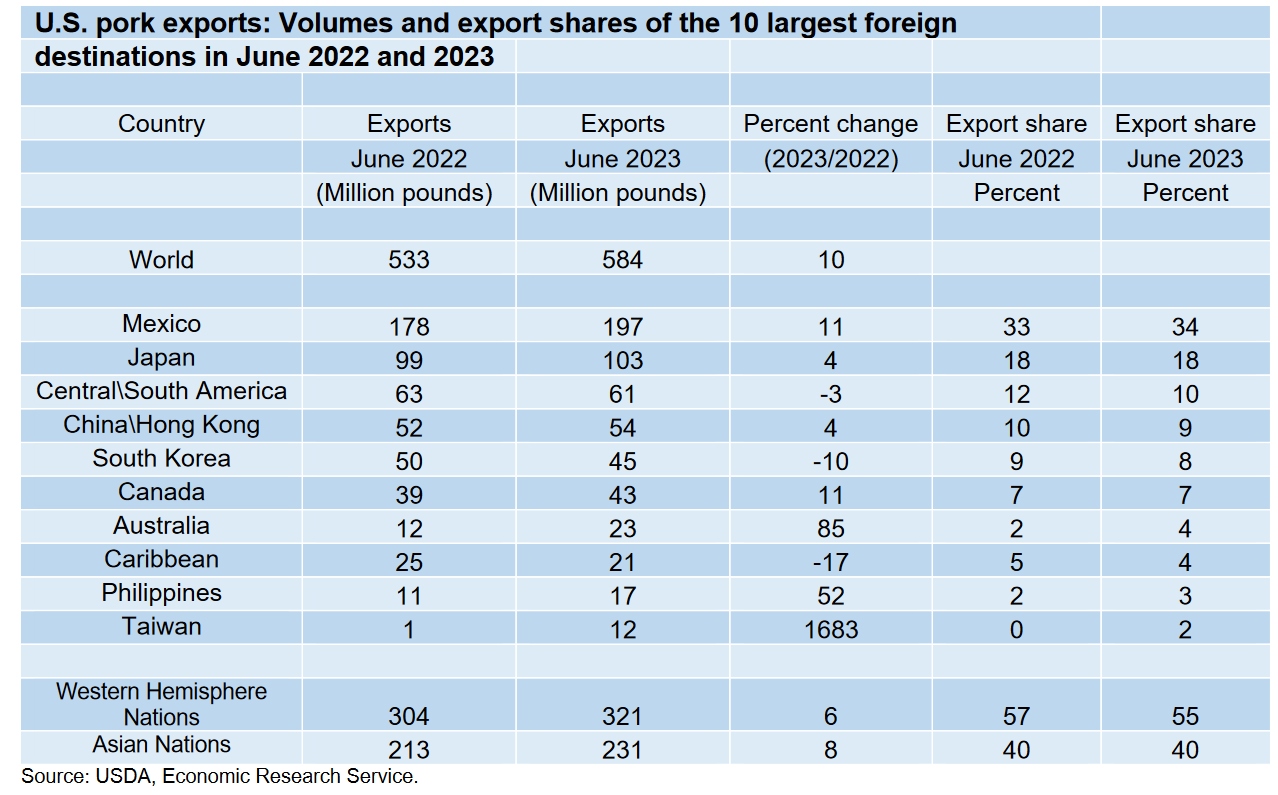

listed below, together with associated export shares. It is notable that in June a higher share of U.S. exports went to Western Hemisphere nations (55 percent) than to Asian countries (40 percent).