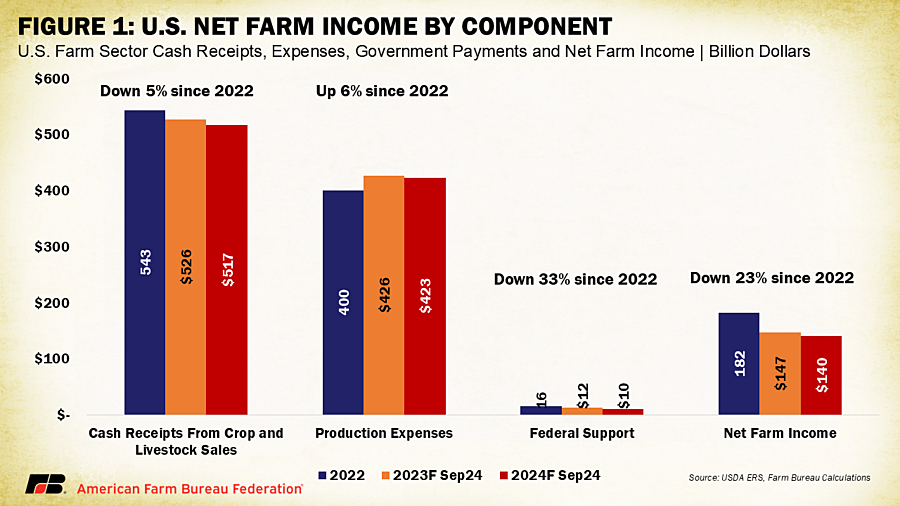

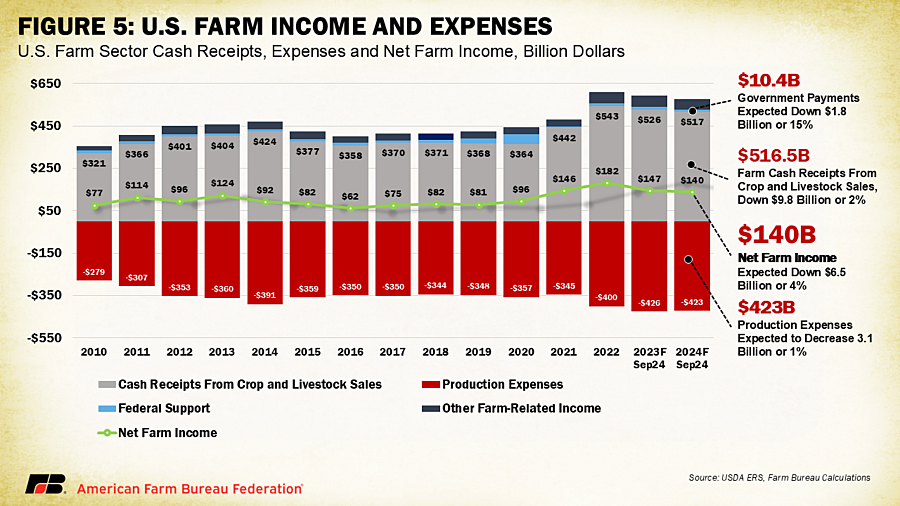

USDA’s September 2024 farm income forecast projects this to be yet another challenging year for American farmers, who are expected to lose nearly a quarter of their income in two years. Net farm income, a key measure of profitability, is forecast at $140 billion for 2024, marking a $6.5 billion decline (4.4%) from 2023, following a sharp 19.5% drop from 2022 to 2023. Inflation-adjusted figures indicate even greater financial strain, with net farm income expected to fall by $10.2 billion (6.8%) from the previous year.

Many agricultural economists had anticipated USDA would lower its February net farm income projections in light of mounting economic pressures. Instead, the September report revised forecasts made in February up, adjusting the original estimate from $116 billion to $140 billion. This upward revision, which places net farm income above the 20-year average (2004–2023), reflects a smaller decline than initially expected. The February estimate had forecast a steep 25.5% drop from 2023, but the updated projection now shows a more moderate 4.4% decrease. USDA also revised net farm income for 2023 down from $155.9 billion to $146.5 billion, which made the decline in 2024 look less extreme. This shift in estimates is largely attributed to a stronger-than-expected performance in the livestock sector and an expected slight decline in total production expenses.

Despite these improvements, however, broader economic pressures persist. Record costs for labor, interest, and taxes, along with reduced government support, continue to present significant challenges for U.S. farmers, who remain financially vulnerable as they head into another difficult year. The unexpected upward revision would appear to offer some relief, but it may understate the economic hurdles farmers – especially crop farmers – are facing in 2024.

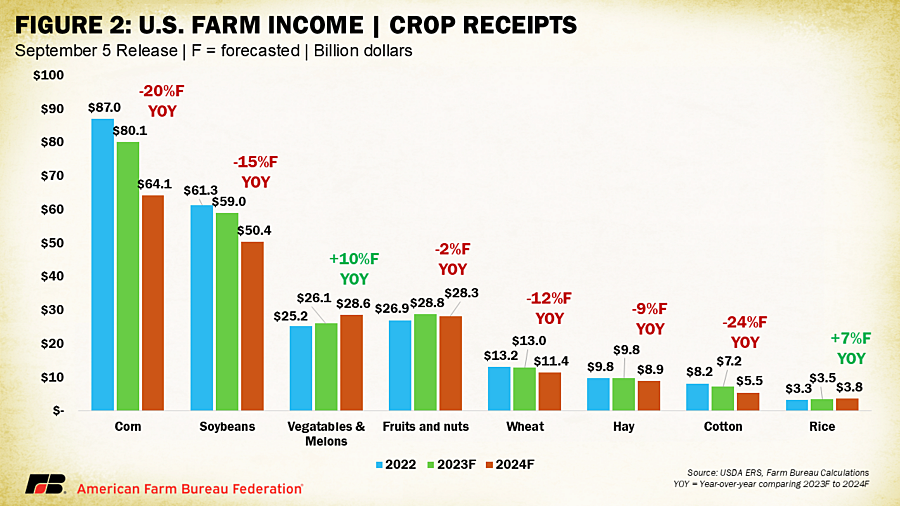

Cash Receipts: Crops Hit Hard

Cash receipts from crop sales are expected to suffer a significant blow in 2024, with a forecasted year-over-year decline of $27.7 billion (10%) to $249 billion. This projected drop is far more severe than the USDA’s original February forecast, which anticipated a $16.7 billion (6%) decrease. Corn receipts, in particular, are forecast to plummet by $16 billion (20%), largely driven by price declines that will more than offset the increase in quantities sold. This represents a sharp downward revision from February’s forecast, which had already projected an $11.3 billion drop in farm sales of corn.

Soybean receipts are also expected to decline steeply, falling by $8.6 billion (14.6%), a much larger drop than the $6 billion (10%) drop initially forecast in February. Other major crops like wheat, cotton, and hay will also experience lower receipts, with cotton expected to fall by $1.7 billion (23.6%) and wheat by $1.6 billion (12.3%).

This sharp downturn in crop cash receipts, despite – or because of – a bumper crop, has been alarming to farmers who have been battling fluctuating commodity prices and rising input costs. The revised 2024 forecast suggests an exceptionally tough year ahead for these producers. The anticipated drop in receipts for grains and oilseeds is largely a result of a global surplus and weaker market prices, offering little relief for growers.

On the bright side, vegetable and melon receipts are expected to rise by $2.5 billion (9.8%) and rice receipts to bump up $250 million (7%), providing a small but positive spot in a sector whose overall outlook remains negative.

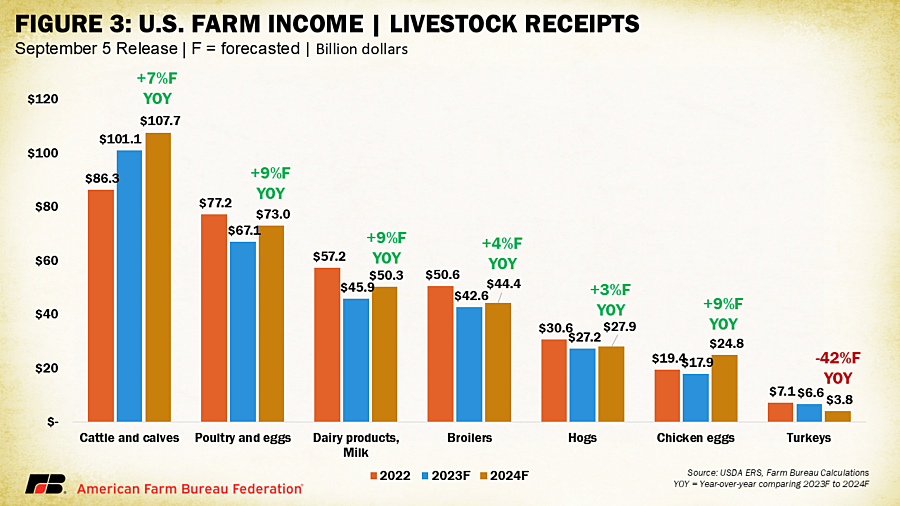

Livestock: Mixed Results

On the livestock side, the original February forecast projected a modest decline of $4.6 billion (1.9%) in total animal product receipts. However, the updated September report presents a far more optimistic outlook, with receipts now expected to rise by $17.8 billion (7.1%) in 2024. This significant upward revision is largely due to stronger-than-anticipated prices across key livestock sectors, particularly for cattle, dairy, and eggs. Egg receipts, originally forecast to drop by 12%, are now expected to surge by 38.7%, reflecting robust price gains linked to the impacts of highly pathogenic avian influenza. USDA also reversed its earlier prediction for cattle and calves, shifting from an estimated $1.6 billion (1.6%) decline to a substantial $6.6 billion (6.5%) increase. Similarly, milk receipts, which were initially projected to fall by $900 million (2%), are now forecast to climb by $4.3 billion (9.4%), driven primarily by higher-than-expected prices.

Despite these gains, not all sectors of the livestock industry are benefiting. Turkey producers are expected to experience a severe downturn, with receipts forecast to drop by $2.7 billion (41.5%). This steep decline reflects weaker consumer demand and lower prices. Likewise, hog producers will see only modest growth, with receipts expected to rise by just $700 million (2.7%). While livestock producers will see some relief in 2024, it will not be uniform.

Government Payments: Fading Safety Nets

Direct government payments, which have provided a critical safety net for farmers in past years, are expected to decrease by $1.8 billion, or 15.1%, to $10.4 billion in 2024. This reduction is largely attributed to lower payments from the Dairy Margin Coverage program and diminished supplemental and ad hoc disaster assistance compared to 2023. The reduction also marks the fourth consecutive year of declining support, reflecting the winding down of pandemic-era programs and the outdated nature of safety net programs like Agriculture Risk Coverage and Price Loss Coverage. As commodity prices remain above outdated reference price levels, these programs rarely trigger, leaving producers exposed to severe financial pressure. This mismatch between current market conditions and program triggers underscores the need for immediate reform.

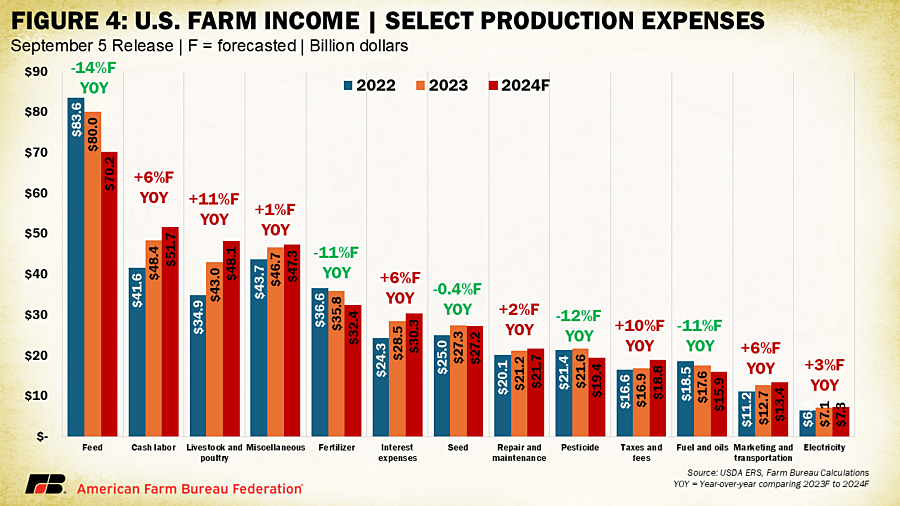

Production Expenses: Marginal Decline with Rising Costs in Key Areas

Total production expenses in 2024 are now forecast to decrease slightly by $4.4 billion (1%) to $457.5 billion, compared to the February report, which initially predicted an increase of $16.7 billion (4%) for the year. While this revision may seem like a positive development, it follows years of record-high expenses, and inflation-adjusted costs remain elevated. Crucially, key cost drivers such as labor and interest expenses are expected to rise, adding continued financial pressure on farmers. In fact, farmers are paying the highest costs on record in dollar terms for labor, interest, and taxes.

Labor costs, for example, are forecast to increase by $3.4 billion (6.9%), while interest expenses are expected to rise by $1.8 billion (6.3%), driven by high interest rates and growing debt levels. Farm sector debt is projected to increase by 4.2%, or $21.8 billion, reaching $540.8 billion in 2024. This rise in debt reflects both higher borrowing needs and sustained high interest rates, further straining farmers’ financial health.

These increases in critical expense areas will offset some of the relief provided by the projected declines in feed, fertilizer, and fuel expenses. Feed costs are now forecast to drop by $9.8 billion (12.3%), fertilizer by $3.5 billion (9.7%), and fuel by $1.7 billion (9.6%) — a marked improvement from the February report, which anticipated smaller reductions in these categories, although the livestock producer’s feed cost savings is the crop farmer’s revenue loss.

Despite the overall decline in total expenses, the rise in labor and interest costs means that farmers will continue to face a tight financial situation in 2024 and beyond. The upward pressure from these persistent costs will strain margins, leaving little room for error as producers navigate a challenging year ahead. The revised estimates provide a mixed picture, where certain cost reductions offer some relief, but the economic reality of record-high labor, interest and tax burdens remains a significant concern.

Conclusion: A Tough Road Ahead

USDA’s 2024 farm income forecast paints a grim picture for American agriculture. Net farm income is set to decline nearly 25% in two years, with substantial losses in crop receipts and continued pressure from rising costs. While livestock producers may see modest gains, the outlook for many crop farmers is increasingly uncertain, with global supply and demand imbalances weighing heavily on prices. The reduced government support, combined with elevated production expenses, leaves many farmers in a precarious financial position.

Notably, in 2022, a record year for net farm income, 57% of farm operations reported a financial loss, according to the Census of Agriculture. This disparity highlights the disconnect between national income averages and the individual financial reality many farmers face. The fact that the majority of farms experienced losses in such a high-income year underscores the fragility of the farm economy, even when the sector as a whole appears strong. Without targeted policy changes, such as an updated safety net in a farm bill, farmers will struggle even more in the face of declining income and rising debt.