Carbon markets are the latest buzz but what exactly are they? How do they work? What questions should you ask?

Ashley McDonald, assistant VP of sustainability at the National Pork Board and Marisa Martin, executive director of the Pollination Group, share their expertise on carbon markets and how they can be leveraged by pork producers.

Full Recording

U.S. pork is part of sustainability solution

For decades, U.S. pork producers have delivered a lean, quality, affordable protein for families around the world while improving soil health and having a low impact on the environment. However, as the global conversation around climate change and food supply continues, the industry receives questions from supply chain partners, conservation community and governments from other countries about sustainability efforts now and in the future.

Pork producers were at the forefront 15 years ago when creating the We Care® Ethical Principles. That foundation has led to the producer-driven We Care goals and metrics that are the U.S. pork industry’s commitment of what we will do tomorrow and into the future.

“We know that the U.S. pork industry is part of the solution. We do things every day on our farms across the U.S. that are sustainable, but we haven’t done a good job of telling that. We’re making a change; we’re making sure that we can know that quantifiably and be able to tell that story.”

Ashley McDonald, Assistant VP of Sustainability, NPB

Measuring and reporting our progress

The critical next step is developing systems to report on progress in achieving sustainability commitments. The National Pork Board has invested checkoff funds into creating an application that:

- Utilizes existing data sources where available

- Finds gaps that we need to fill

- Produces individual reports for producers

- Produces aggregated reports at the state and national levels to tell story of progress

On-Farm Sustainability Reports are valuable tools

On-farm sustainability reports are available for all pork producers, providing powerful data to use as a decision-making tool at the farm level and to share with land owners and lenders. At state and national levels, aggregate numbers can tell a powerful story for supply chain partners, consumers and more. Continual enhancements being make, including a carbon credit footprint calculator that can be the first step for producers to participate in carbon marketplace programs.

“It is not a verified carbon credit, it the first step that anybody who happens to be interested in entering a carbon program should take. It is more than just carbon of course, it includes water and conservation practices. But, if you are interested in taking the next step into the carbon programs, it can give you a lot of valuable information about your operation and ideas of what you can do going into the future to improve those outcomes.”

Ashley McDonald, Assistant VP of Sustainability, NPB

Understanding carbon credits and carbon markets

According to Martin, the purpose of carbon markets is to fund practices or programs that can reduce or remove carbon atmosphere, that would not have otherwise occurred.

- A carbon credit, or carbon offset, is equal to a metric ton of carbon dioxide reduced or removed

- An example of a reduction is using less fertilizer than in previous years. The difference between the standard practice and lower amount would be eligible for a carbon credit.

- An example of a removal is sequestering carbon in soils through cover crops or other practice. This removal of carbon dioxide from the atmosphere can be quantified as a carbon credit.

There are two types of carbon markets: compliance and voluntary.

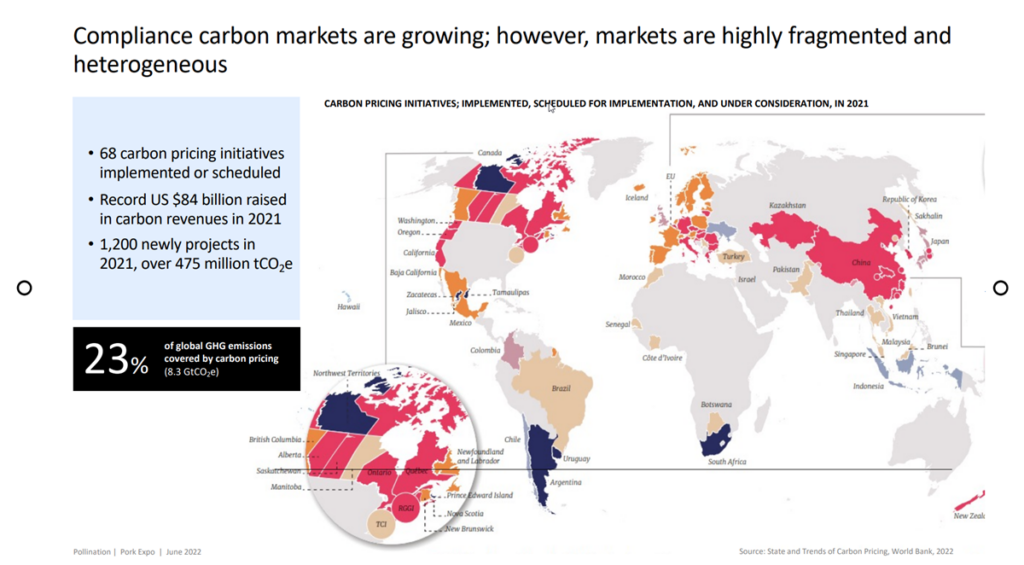

- Compliance carbon markets are created by law and require high emitting sectors, such as energy or oil industries, to offset their carbon emissions. Agriculture is not included in these regulated markets, but can benefit from selling carbon credits to high-emitting sectors. Compliance carbon markets are growing, with 68 carbon pricing initiatives implemented or scheduled.

- Voluntary carbon markets are not created by law, and are administered by private entities or non-government organizations (NGOs). These are being driven primarily by demand for carbon credits by corporations setting voluntary targets. They are harder to track because there is no requirement to disclose number of credits sold or the price; however the reported total value exceeded $1 billion for the first time in 2021.

Nature based solutions to carbon reduction or removal are a quickly growing segment. Agriculture represents a small, but growing percentage of global nature-based climate solutions to date, growing from 1.76% in 2020 to 9% in 2021. Nature-based solutions represented about 45% of total solutions in 2021.

Creating a carbon credit

If you are interested in creating a carbon offset that can be sold, there are several steps:

- Determine eligible activity

- Register project with standard or sign up with an aggregator

- Implement activities

- Verify impact with third party verifier

- Issue of credits to participant/aggregator

- Sell credits on registry

Environmental integrity determines value

An important part of all carbon credit projects is that they have environmental integrity to achieve climate change goals. These factors also impact the financial value of the credit. Attributes include:

- The credit must be real and represent one tonne of carbon dioxide equivalent reduced or removed from the atmosphere. It can be difficult to confirm and quantify.

- Emission reductions or removals must be additional to existing practices or common practices. This is often a challenge for farmers because only those engaging in practices for the first time and where it is not a common practice may earn carbon credits.

- The carbon reduction or removal must be permanent. Nature-based practices such as soil carbon sequestration can be reversed or carbon may be released, so must be managed closely.

- Carbon credits must be verifiable by third parties.

- Activity doesn’t lead to leakage, in which the reduction from one practice doesn’t result in increased carbon production or release in another area.

Opportunities for climate-smart agricultural practices

Agricultural climate-smart practices represent an opportunity for U.S. to meet its Paris Agreement goals of reducing greenhouse gas emissions by 50-52% below 2005 levels by 2030 and net zero emissions by 2050.

- The electricity, transport and industry sectors have been focus of regulators because they make up combined 83% of emissions

- Agriculture contributes about 10% of national greenhouse gas emissions, and is generally seen as a sector for reductions to achieve goals.

Agronomic activities that are eligible to generate carbon credits via a voluntary methodology include:

- Reduced fertilizer applications

- New no-till, strip-till or reduced till practices; new cover crops; rotation diversification, crop diversification and intercropping, direct seeding,

- Increasing soil organic carbon

Swine management activities that are eligible to generate carbon credits via voluntary or compliance methodologies include:

- Improved manure management, specifically methane capture and destruction

- Biodigesters

“Forestry and ag are on the upswing. I think that’s because people are really focused on the story behind carbon credits, especially in ag and forestry. They like the connection back to the land, the co-benefits of biodiversity. You’re getting the carbon credits, but you’re getting all these other things, too, improved soil health, etc. I think that has really driven a lot of the increase in ag-based and forestry.”

Marisa Martin, Executive Director of the Pollination Group

“The demand for removals in particular, the soil carbon projects of the world, where you’re actually pulling carbon out of the atmosphere and sequestering it, same with reforestation where the trees are pulling carbon out – those have been increasingly popular, and I think we’ll see that there is a price differential between removal credits and reduction credits, because as they decarbonize, corporates need to offset the emissions they can’t otherwise abate.”

Marisa Martin, Executive Director of the Pollination Group

Opportunities and challenges ahead

There is significant promise for soil carbon projects, but concerns about environmental integrity must be overcome:

- U.S. cropland has potential to sequester significant amounts of carbon

- Increased demand for offsets from corporations, especially carbon removal projects, is driving interest

- Integrity issues remain a challenge, especially risk of release of soil carbon and measurement challenges

- The market is pushing for more robust methodologies and measurements to answer questions and address challenges.

There are three areas that producers can engage in carbon markets today. Each requires an analysis of costs and opportunities and the entire marketplace is quickly evolving.

- Established standards bodies

- New market entrants, with many focused on soil carbon

- Corporate initiatives

Considerations for producers entering carbon marketplace

Producers have a number of items to consider as they make decisions on credits before entering the market. Determining which engagement option is the right fit is specific to each farm and operation.

Carbon markets may be a fit for some producers and geographies, other ways to fund climate-smart activities include:

- Renewable energy certificates

- California low-carbon fuel standard credits

- Payment for ecosystem services schemes

- Green bonds or other emerging financial instruments, tax credits

- Incentives, grants, results-based supply chain financing