2021 China Hog Market Key Statistics

Hog Stock: According to official data, China has 449.22 million hogs at year end 2021, up 10.5% from prior year. It is noticeable that current hog stock level has already exceeded that of the pre-ASF years 2016-2018 and is 44.7% above the hardest hit 2019.

Hog Sales: Total hog sales were 671.28M, up 27.4% year-on-year. This is approximately 97% of the 2018 figure. It is evident that the supply shock due to African Swine Fever is now behind us.

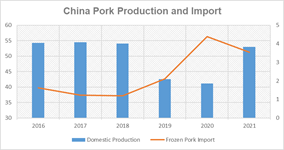

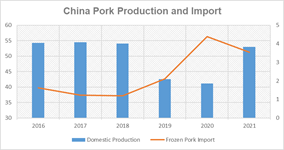

Pork Production: 52.96 million metric tons, up 38% year-on-year. This is approximately 97% of the 2017 production level.

Pork Import: China imported 3.71 million tons of frozen pork last year, down 15.5% from the record 4.39 million reached in 2020. Main factors driving the huge decline: Domestic pork supply has recovered; pork price drops 60% throughout the year; and pork consumption has been negatively impacted by Covid related restrictions.

Data source: China Statistics Bureau and China Customs. Unit: Million tons

Pork Price Trend: Starting from RMB 35.68 per kg at the beginning of 2021, wholesale pork price declined sharply to 15.00 by July, down 57.9%. Average whole sales pork price on February 16th was 24.80. (Note: US$1≈RMB6.33 yuan) While US pork price has been risen 40% due to supply issue and high inflation, China face a very different market fundamental – ample supply and suppressed demand.

China Wholesale Pork Price

Data source: Ministry of Agriculture. Unit: RMB per kg

Hog Feed Production: Annual hog feed production is estimated at 128 million tons, up 44% from prior year. Feed data is in line with the trend we see in the fast recovery of hog production.

Top Hog Producers: Top-10 publicly traded Chinese producers sold 94.4 million hogs last year, up 72% from 2020. Together, they contributed to 14% of China’s hog production.

2022 China Hog Market Outlook

Sow Stock at Recent-Year High

At Year End 2021, China has 43.29 million sows, up 4% from prior year, but is 113% above the 2019 level of 20.29 million.

High Feed Cost Puts Pressure on Hog Margin

At RMB 3.34 per kg at the end of January, hog feed cost is 30% above 2019 level. Elevated prices of corn and soybean mean that hog production cost will remain high in the coming months. Farmers continue to sustain large loss at current low hog price.

China Hog Feed Cost

It will take years to reverse past expansion

In 2020, supported by high hog price and stock price, large producers went on to a buildup spree. While this has slowed last year, liquidation is not in the plan. Public companies raised large sum to build hog farms. They must continue to produce in order to service debt.

The mainstream thinking is that when pork price starts to rise again, they would make up for the loss from a bigger capacity.

Overall, we expect China’s hog price to remain low throughout 2022. Ample sow stock and weak consumption mean that future hog supply will be large relative to pork demand. Even if liquidation occurs, it may not be adequate to bring hog price up to the 20-yuan level.

This is bad news for European and American pork exporters. China’s need for meat import will be low this year, and there isn’t any price differential to make the international trade profitable.

However, with a huge herd of livestock to feed, China’s appetite for corn and soybean in the global market will be very sizeable.

Jim W. Huang, CFA

Email: jimwenhuang@gmail.com